Rising Prevalence of ADHD

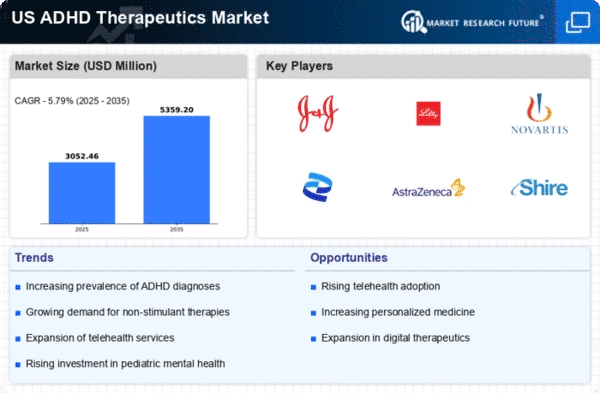

The increasing prevalence of Attention Deficit Hyperactivity Disorder (ADHD) in the United States is a primary driver of the ADHD therapeutics market. Recent estimates suggest that approximately 9.4% of children aged 2-17 years have been diagnosed with ADHD, leading to a growing demand for effective treatment options. This rising incidence is not limited to children; adults are also increasingly diagnosed, expanding the target demographic for ADHD therapeutics. As awareness of ADHD improves, more individuals seek diagnosis and treatment, further propelling market growth. The ADHD Therapeutics Market is expected to witness a compound annual growth rate (CAGR) of around 7% over the next few years, driven by this rising prevalence and the subsequent need for innovative therapeutic solutions.

Advancements in Drug Development

Innovations in drug development are significantly impacting the ADHD therapeutics market. Pharmaceutical companies are increasingly investing in research and development to create novel medications that offer improved efficacy and safety profiles. Recent advancements include the development of non-stimulant medications and extended-release formulations, which cater to diverse patient needs. The ADHD therapeutics market is projected to reach approximately $20 billion by 2026, driven by these advancements. Furthermore, the introduction of digital therapeutics and mobile applications for ADHD management is likely to enhance treatment adherence and patient outcomes, thereby expanding the market further. These developments indicate a shift towards more comprehensive and effective treatment strategies.

Increased Awareness and Education

Growing awareness and education regarding ADHD among healthcare professionals and the general public are crucial drivers of the ADHD therapeutics market. Initiatives aimed at educating parents, teachers, and healthcare providers about ADHD symptoms and treatment options have led to earlier diagnosis and intervention. This heightened awareness is reflected in the increasing number of prescriptions for ADHD medications, which have risen by over 30% in recent years. As more individuals recognize the importance of addressing ADHD, the demand for therapeutics is likely to continue its upward trajectory. The ADHD therapeutics market benefits from this trend, as it fosters a more informed patient population that actively seeks treatment.

Integration of Telehealth Services

The integration of telehealth services into the management of ADHD is emerging as a significant driver of the ADHD therapeutics market. Telehealth offers patients convenient access to healthcare professionals, enabling timely diagnosis and treatment. This is particularly beneficial for individuals in remote areas or those with mobility challenges. The COVID-19 pandemic accelerated the adoption of telehealth, and this trend appears to be continuing, with many patients preferring virtual consultations. As telehealth becomes a standard practice in ADHD management, it is expected to enhance treatment adherence and patient engagement. Consequently, the ADHD therapeutics market is likely to expand as more individuals seek and receive appropriate care through these innovative platforms.

Regulatory Support for ADHD Treatments

Regulatory support for ADHD treatments plays a vital role in shaping the ADHD therapeutics market. The U.S. Food and Drug Administration (FDA) has streamlined the approval process for new ADHD medications, facilitating quicker access to innovative therapies. This regulatory environment encourages pharmaceutical companies to invest in research and development, knowing that their products can reach the market more efficiently. Additionally, recent policies aimed at improving access to mental health services have further bolstered the ADHD therapeutics market. As regulations evolve to support the development and distribution of ADHD treatments, the market is likely to experience sustained growth, benefiting both patients and healthcare providers.