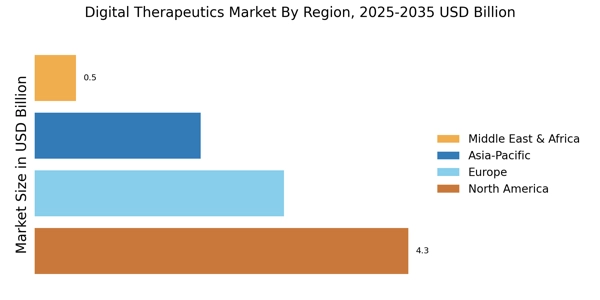

North America : Leading Digital Health Innovators

North America accounted for the largest share of the global Digital Therapeutics Market size, reaching USD 4.3 billion in 2024. The region's growth is driven by increasing healthcare costs, a rising prevalence of chronic diseases, and a strong focus on preventive care. Regulatory support from agencies like the FDA has catalyzed innovation, allowing for rapid development and deployment of digital health solutions. The demand for personalized healthcare solutions is also on the rise, further propelling market growth.

The United States is the leading country in this sector, with significant contributions from companies like Omada Health, Pear Therapeutics, and WellDoc. Canada follows as the second-largest market, focusing on integrating digital therapeutics into its healthcare system. The competitive landscape is characterized by a mix of established players and startups, fostering innovation and collaboration. The presence of key players enhances the region's position as a hub for digital health advancements.

Europe : Emerging Digital Health Landscape

Europe Digital Therapeutics Market was valued at USD 2.877 billion in 2024, making it the second-largest regional market with a 30% share. Key growth drivers include increasing healthcare digitization, supportive regulatory frameworks, and a growing emphasis on mental health solutions. The European Union's initiatives to promote digital health technologies have created a conducive environment for market growth, with countries like Germany and France leading the charge in adoption and integration of these solutions.

Germany is at the forefront, with a robust regulatory framework that supports digital health innovations, followed by France and the UK. The competitive landscape features a mix of local startups and established companies, such as MySugr and Big Health, which are making significant strides in the market. The presence of these key players, along with increasing investment in digital health, is expected to drive further growth in the region.

Asia-Pacific : Rapidly Growing Market Potential

Asia-Pacific is emerging as a significant player in the digital therapeutics market, holding around 20% of the global share. The region's growth is fueled by increasing smartphone penetration, a rising prevalence of lifestyle-related diseases, and government initiatives aimed at enhancing healthcare access. Countries like China and India are leading the charge, with substantial investments in digital health technologies and a growing acceptance of telehealth solutions among consumers.

China is the largest market in the region, driven by a vast population and increasing healthcare expenditure. India follows closely, with a burgeoning startup ecosystem focused on digital health solutions. The competitive landscape is diverse, featuring both local and international players, including DarioHealth and Happify Health. The increasing collaboration between tech companies and healthcare providers is expected to further accelerate market growth in this region.

Middle East and Africa : Emerging Digital Health Solutions

The Middle East and Africa region is gradually embracing digital therapeutics, currently holding about 5% of the global market share. The growth is driven by increasing internet penetration, a rising focus on healthcare innovation, and government initiatives aimed at improving healthcare delivery. Countries like South Africa and the UAE are at the forefront, implementing policies to support digital health solutions and enhance patient care. South Africa is leading the market, with a growing number of startups focusing on digital health solutions.

The UAE is also making significant strides, with government-backed initiatives promoting telehealth and digital therapeutics. The competitive landscape is characterized by a mix of local startups and international players, creating opportunities for collaboration and innovation in the region. The increasing awareness of mental health issues is further propelling the demand for digital therapeutic solutions.