Top Industry Leaders in the Unmanned Composites Market

Strategies Adopted:

- Product Innovation: Key players focus on developing lightweight, high-strength composite materials tailored for unmanned systems, such as drones and UAVs, to enhance performance, durability, and operational efficiency.

- Strategic Partnerships: Collaboration with drone manufacturers, defense contractors, and research institutions enables companies to co-develop advanced composite solutions, integrate new materials, and address specific application requirements.

- Vertical Integration: Vertical integration across the supply chain, from raw material production to finished component manufacturing, allows companies to optimize production processes, ensure quality control, and reduce lead times, enhancing competitiveness.

- Market Expansion: Companies expand their geographic presence through acquisitions, joint ventures, and establishing manufacturing facilities and distribution networks in key regions to capitalize on growing demand for unmanned composites worldwide.

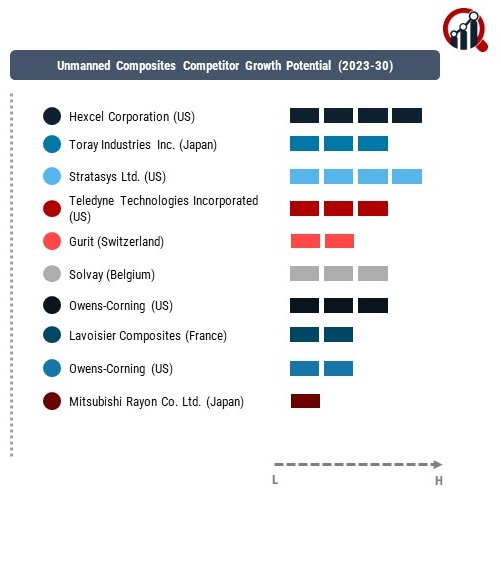

Key Companies in the unmanned composites market include.

- Hexcel Corporation (US)

- Toray Industries Inc. (Japan)

- Stratasys Ltd. (US)

- Teledyne Technologies Incorporated (US)

- Gurit (Switzerland)

- Solvay (Belgium)

- Owens-Corning (US)

- Lavoisier Composites (France)

- Owens-Corning (US)

- Mitsubishi Rayon Co. Ltd. (Japan)

Factors for Market Share Analysis:

- Material Performance: Market share analysis considers the mechanical properties, weight-to-strength ratio, and fatigue resistance of composite materials, with companies offering advanced solutions with superior performance commanding a larger market share.

- Application Diversity: The breadth of applications served, including airframes, propulsion systems, payloads, and structural components, influences market share, reflecting versatility, adaptability, and compatibility with diverse unmanned platforms.

- Industry Certifications: Compliance with industry standards, such as ISO 9001, AS9100, and NADCAP (National Aerospace and Defense Contractors Accreditation Program), is essential for market share, demonstrating quality assurance and adherence to regulatory requirements.

- Customer Relationships: Strong relationships with OEMs, defense agencies, and aerospace contractors, built on reliability, technical expertise, and customer support, contribute to market share by fostering loyalty and repeat business.

Industry News:

- Sustainable Solutions: Industry news highlights the development of sustainable composite materials, including bio-based resins, recycled fibers, and eco-friendly manufacturing processes, aligning with environmental regulations and customer demand for green solutions.

- Automation and Robotics: Increasing adoption of automated manufacturing processes, robotics, and digital twin technologies improves production efficiency, reduces labor costs, and enhances quality control in unmanned composite manufacturing.

- Advanced Testing Methods: Industry news focuses on the adoption of advanced testing methods, such as non-destructive testing (NDT), digital X-ray, and thermography, to ensure the quality, integrity, and performance of composite components for unmanned systems.

- Regulatory Compliance: Companies invest in regulatory compliance initiatives, including material qualification testing, certification documentation, and traceability systems, to meet stringent aerospace standards and ensure product reliability and safety.

Current Company Investment Trends:

- R&D Investments: Key players continue to invest in research and development to develop next-generation composite materials, manufacturing processes, and design optimization tools tailored for unmanned applications, driving innovation and differentiation.

- Industry Consolidation: Consolidation through mergers and acquisitions enables companies to expand market share, gain access to new technologies and capabilities, and enhance competitiveness in the unmanned composites market.

- Supply Chain Optimization: Investments in supply chain optimization, including supplier relationship management, inventory management, and logistics, aim to improve operational efficiency, reduce costs, and mitigate supply chain risks.

- Customer-Centric Solutions: Companies prioritize customer-centric solutions by offering customizable composite materials, engineering services, and technical support to address specific customer needs and enhance customer satisfaction and loyalty.

Unmanned Composites Industry Developments

In March of 2019,

Hexcel Corporation has collaborated with Lavoisier Composites (France) to expand its product portfolio with carbon composite materials and by-products developed by Lavoisier Composites.

For instance, In March 2019,

Toray Industries created Polyphenylene Sulfide Resin, a composite material with high flexibility, heat resistance, and chemical resistance that is primarily used in automotive applications.

For instance, In July of 2019,

Tejin Limited acquired J. H. Ziegler GmbH (Germany) in order to expand its composites product portfolio for the automotive industry.