Rising Military and Defense Expenditures

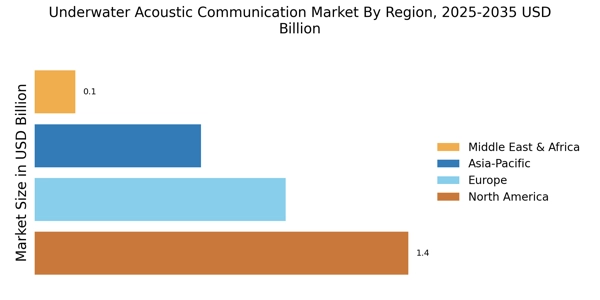

The Underwater Acoustic Communication Market is significantly influenced by the rising military and defense expenditures across various nations. As geopolitical tensions escalate, countries are investing heavily in advanced underwater communication systems to enhance their naval capabilities. These systems are crucial for submarine operations, underwater surveillance, and anti-submarine warfare. The market is anticipated to benefit from increased defense budgets, with estimates suggesting that military spending on underwater technologies could reach USD 15 billion by 2026. This trend indicates a strong demand for sophisticated acoustic communication solutions that can operate effectively in hostile environments. Consequently, the Underwater Acoustic Communication Market is poised for growth as defense sectors prioritize the development of advanced underwater communication technologies.

Expansion of Offshore Oil and Gas Activities

The Underwater Acoustic Communication Market is significantly impacted by the expansion of offshore oil and gas activities. As energy demands increase, companies are exploring deeper and more challenging underwater environments for resource extraction. Effective communication systems are essential for coordinating operations, ensuring safety, and monitoring environmental impacts. The market is expected to grow in tandem with the offshore oil and gas sector, which is projected to invest over USD 200 billion in underwater exploration and production technologies by 2028. This investment will likely drive demand for advanced acoustic communication systems that can withstand harsh underwater conditions. Consequently, the Underwater Acoustic Communication Market is positioned to benefit from the ongoing expansion of offshore energy activities.

Increasing Demand for Underwater Exploration

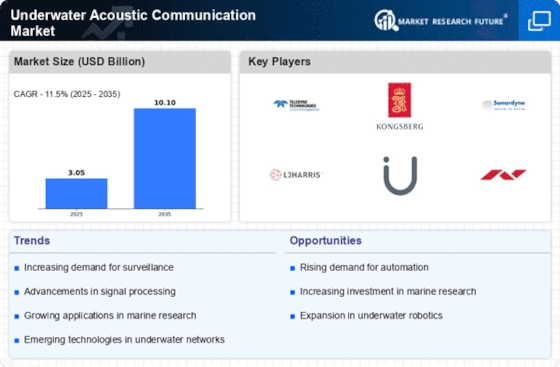

The Underwater Acoustic Communication Market is experiencing a surge in demand driven by the increasing need for underwater exploration. This demand is largely attributed to the growing interest in marine biology, underwater archaeology, and resource extraction. As nations seek to explore their maritime territories, the need for effective communication systems becomes paramount. The market is projected to grow at a compound annual growth rate of approximately 10% over the next five years, reflecting the rising investments in underwater research and exploration technologies. Enhanced acoustic communication systems facilitate real-time data transmission, which is crucial for researchers and explorers operating in challenging underwater environments. This trend indicates a robust future for the Underwater Acoustic Communication Market as it aligns with the global push for sustainable resource management and environmental conservation.

Environmental Monitoring and Conservation Efforts

The Underwater Acoustic Communication Market is increasingly driven by environmental monitoring and conservation initiatives. As awareness of marine ecosystem health grows, there is a pressing need for effective communication systems to monitor underwater environments. These systems facilitate the collection of data on marine life, water quality, and habitat conditions, which are essential for conservation efforts. Governments and organizations are investing in technologies that enable real-time monitoring of underwater ecosystems, with the market projected to grow by approximately 8% annually over the next few years. This growth reflects a commitment to sustainable practices and the protection of marine biodiversity. The Underwater Acoustic Communication Market is thus becoming integral to environmental stewardship and research.

Advancements in Underwater Communication Technologies

Technological innovations are significantly shaping the Underwater Acoustic Communication Market. Recent advancements in signal processing, modulation techniques, and hardware design have led to the development of more efficient and reliable underwater communication systems. These technologies enable higher data rates and improved range, which are essential for various applications, including military operations, environmental monitoring, and offshore oil and gas exploration. The integration of artificial intelligence and machine learning into these systems is also emerging, potentially enhancing their capabilities. As a result, the market is expected to witness a substantial increase in adoption rates, with projections indicating a market value exceeding USD 1 billion by 2027. This growth underscores the importance of continuous innovation in the Underwater Acoustic Communication Market.