Growing Demand for Energy Security

The Europe Shale Gas Market is driven by an increasing demand for energy security among European nations. As geopolitical tensions and supply chain vulnerabilities persist, countries are seeking to reduce their dependence on imported fossil fuels. Shale gas presents a viable alternative, offering a domestic source of energy that can enhance energy independence. In 2025, it is estimated that shale gas could account for up to 15% of the total natural gas supply in Europe, providing a buffer against external supply disruptions. This growing emphasis on energy security is likely to spur investments in shale gas exploration and production, further solidifying its role in the European energy landscape.

Regulatory Support and Policy Frameworks

The regulatory landscape surrounding the Europe Shale Gas Market is evolving, with governments recognizing the potential of shale gas as a domestic energy source. Several European countries have implemented supportive policies aimed at facilitating exploration and production activities. For example, the UK government has introduced streamlined permitting processes and incentives for shale gas projects, which could lead to increased investment in the sector. Additionally, the European Commission has emphasized the importance of energy diversification, which aligns with the development of shale gas resources. As a result, the regulatory framework is becoming more conducive to shale gas exploration, potentially leading to a significant increase in production levels in the coming years.

Investment Opportunities and Economic Growth

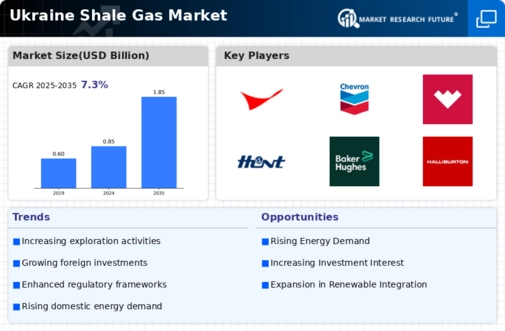

The Europe Shale Gas Market presents numerous investment opportunities that could stimulate economic growth across the region. With the potential for substantial shale gas reserves, countries like Poland and the UK are attracting foreign investments aimed at developing their shale gas resources. In 2025, it is projected that investments in the European shale gas sector could exceed 5 billion euros, driven by both domestic and international players. This influx of capital is likely to create jobs, boost local economies, and enhance energy infrastructure. Furthermore, as the market matures, the potential for technological partnerships and collaborations may emerge, fostering innovation and further economic development in the shale gas industry.

Technological Advancements in Extraction Techniques

The Europe Shale Gas Market is experiencing a surge in technological advancements that enhance extraction techniques. Innovations such as hydraulic fracturing and horizontal drilling have significantly improved the efficiency of shale gas extraction. For instance, the European Union has invested in research and development to optimize these technologies, leading to increased production rates. As of 2025, shale gas production in Europe has reached approximately 10 billion cubic meters, indicating a growing reliance on these advanced methods. Furthermore, the integration of digital technologies, such as data analytics and automation, is likely to streamline operations, reduce costs, and minimize environmental impacts. This technological evolution not only boosts production but also positions Europe as a competitive player in The Shale Gas.

Environmental Considerations and Sustainable Practices

The Europe Shale Gas Market is increasingly influenced by environmental considerations and the push for sustainable practices. While shale gas is often viewed as a cleaner alternative to coal, concerns regarding water usage and potential contamination have prompted the industry to adopt more sustainable extraction methods. Companies are now investing in technologies that minimize environmental impacts, such as water recycling and reduced emissions techniques. As public awareness of environmental issues grows, regulatory bodies are likely to impose stricter guidelines, which could drive innovation in sustainable practices within the shale gas sector. This focus on sustainability may enhance the industry's reputation and facilitate its acceptance among stakeholders.