Growing Awareness and Training Programs

The transradial access-devices market is also being driven by increasing awareness and the establishment of training programs for healthcare professionals. As more clinicians become educated about the benefits of transradial access, the adoption of these techniques is expected to rise. Various medical institutions and organizations in the UK are implementing training initiatives to equip healthcare providers with the necessary skills to perform transradial procedures effectively. This growing emphasis on education and training is likely to enhance the proficiency of clinicians, thereby fostering greater acceptance and utilization of transradial access devices in clinical practice.

Supportive Healthcare Policies and Funding

The transradial access-devices market is benefiting from supportive healthcare policies and increased funding aimed at improving cardiovascular care in the UK. Government initiatives focused on enhancing healthcare infrastructure and promoting innovative medical technologies are creating a conducive environment for market growth. Additionally, funding for research and development in cardiovascular devices is on the rise, which may lead to the introduction of new and improved transradial access devices. This supportive landscape is likely to encourage healthcare providers to adopt transradial techniques, further driving the market's expansion.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in the UK is a significant driver for the transradial access-devices market. With heart disease being one of the leading causes of mortality, the demand for effective diagnostic and therapeutic interventions is on the rise. According to recent statistics, cardiovascular diseases account for nearly 30% of all deaths in the UK. This alarming trend necessitates the use of advanced access devices that facilitate procedures such as angioplasty and stenting. Consequently, the transradial access-devices market is expected to witness substantial growth as healthcare providers seek to improve patient outcomes in the face of rising cardiovascular health challenges.

Technological Innovations in Access Devices

Technological advancements in the design and functionality of transradial access-devices are propelling the market forward. Innovations such as improved catheter designs, enhanced hemostatic devices, and advanced imaging technologies are making procedures safer and more efficient. The introduction of smart access devices that integrate with digital health platforms is also gaining traction. These innovations not only improve procedural success rates but also enhance patient monitoring and post-operative care. As the transradial access-devices market continues to evolve, the integration of cutting-edge technology is likely to play a pivotal role in shaping its future.

Increasing Demand for Minimally Invasive Procedures

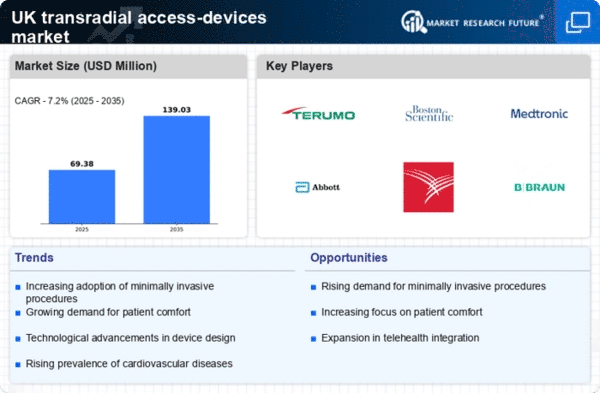

The transradial access-devices market is experiencing a notable surge in demand due to the growing preference for minimally invasive procedures among healthcare professionals and patients alike. This trend is driven by the advantages associated with transradial access, such as reduced recovery time, lower complication rates, and enhanced patient comfort. In the UK, the market for minimally invasive cardiovascular procedures is projected to grow at a CAGR of approximately 8% over the next five years. As more clinicians adopt transradial techniques, the transradial access-devices market is likely to expand, reflecting the shift towards less invasive surgical options.