Market Growth Projections

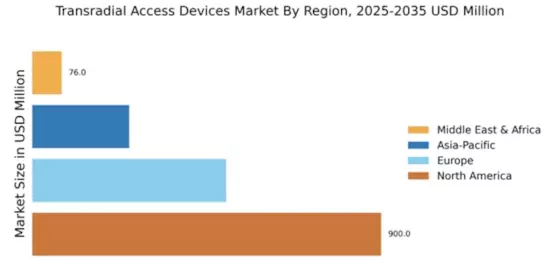

The Global Transradial Access Devices Market Industry is poised for substantial growth, with projections indicating a market value of 1.73 USD Billion in 2024 and an anticipated increase to 3.71 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.18% from 2025 to 2035. Such figures highlight the increasing adoption of transradial access techniques across healthcare facilities worldwide. The market's expansion is likely driven by factors such as technological advancements, rising cardiovascular disease prevalence, and a growing preference for minimally invasive procedures. These projections underscore the promising future of the transradial access devices market.

Rising Geriatric Population

The increasing geriatric population worldwide is a significant driver of the Global Transradial Access Devices Market Industry. As individuals age, they are more susceptible to cardiovascular diseases, necessitating effective treatment options. According to demographic studies, the global population aged 65 and older is expected to double by 2050, leading to a higher demand for cardiovascular interventions. This demographic shift compels healthcare systems to adopt transradial access techniques, which are often safer for older patients. Consequently, the market for transradial access devices is likely to expand, driven by the need to cater to this growing patient population and their specific healthcare requirements.

Enhanced Training and Awareness Programs

The implementation of enhanced training and awareness programs for healthcare professionals is positively impacting the Global Transradial Access Devices Market Industry. As more medical institutions recognize the benefits of transradial access, they are investing in training initiatives to equip practitioners with the necessary skills. These programs not only improve procedural success rates but also foster greater confidence among healthcare providers. Increased awareness of the advantages of transradial access, such as reduced bleeding complications and faster recovery times, is likely to drive adoption rates. As a result, the market is expected to witness substantial growth, reflecting the commitment to improving patient care through education and training.

Technological Advancements in Medical Devices

Technological innovations play a crucial role in shaping the Global Transradial Access Devices Market Industry. Recent advancements in device design, materials, and imaging technologies have enhanced the safety and efficacy of transradial procedures. For instance, the introduction of ultra-thin catheters and advanced hemostatic devices has improved patient outcomes significantly. These innovations not only facilitate easier access but also reduce the risk of complications, thereby encouraging more healthcare facilities to adopt transradial access techniques. As the market evolves, it is anticipated that the industry will experience a compound annual growth rate of 7.18% from 2025 to 2035, driven by continuous technological improvements.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases globally is a primary driver for the Global Transradial Access Devices Market Industry. As the World Health Organization indicates, cardiovascular diseases account for approximately 32% of all global deaths. This alarming statistic propels healthcare providers to adopt transradial access techniques, which are associated with lower complication rates compared to traditional methods. The market is projected to reach 1.73 USD Billion in 2024, reflecting the urgent need for effective intervention strategies. Consequently, the demand for transradial access devices is expected to surge as healthcare systems prioritize innovative solutions to combat this growing health crisis.

Growing Preference for Minimally Invasive Procedures

The shift towards minimally invasive procedures is increasingly influencing the Global Transradial Access Devices Market Industry. Patients and healthcare providers alike favor these techniques due to their associated benefits, such as reduced recovery times and lower complication rates. Transradial access, in particular, offers a less invasive alternative to traditional femoral access, leading to shorter hospital stays and improved patient satisfaction. As more practitioners recognize these advantages, the demand for transradial access devices is expected to rise. This trend aligns with the projected market growth, which is anticipated to reach 3.71 USD Billion by 2035, reflecting the ongoing transition towards less invasive medical practices.