Increased Focus on Preventive Care

An increased focus on preventive care is significantly influencing the telemedicine market in the UK. Healthcare providers are recognizing the importance of early intervention and regular monitoring to prevent chronic diseases. Telemedicine facilitates this by enabling remote consultations and continuous health monitoring, which can lead to better health outcomes. Recent data indicates that nearly 25% of telemedicine consultations are related to preventive care services, highlighting a shift in patient priorities. This trend is likely to encourage more healthcare providers to incorporate telehealth solutions into their practices, thereby expanding the telemedicine market. As preventive care becomes a central theme in healthcare strategies, the demand for telemedicine services is expected to rise.

Rising Demand for Accessible Healthcare

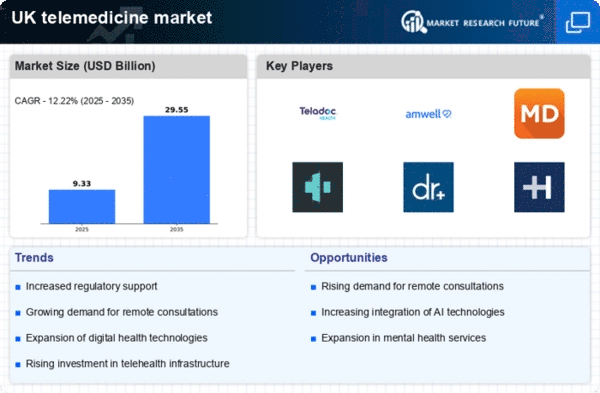

The telemedicine market in the UK is experiencing a notable surge in demand for accessible healthcare services. This trend is driven by an increasing population that seeks convenient medical consultations without the need for physical visits. According to recent data, approximately 30% of patients prefer telemedicine options for routine check-ups and follow-ups. This shift is particularly evident among younger demographics who are more tech-savvy and comfortable with digital health solutions. The telemedicine market is thus adapting to meet these needs, offering a range of services that enhance patient engagement and satisfaction. As healthcare providers expand their telehealth offerings, the market is likely to see further growth, potentially reaching a valuation of £5 billion by 2027. This demand for accessibility is reshaping the landscape of healthcare delivery in the UK.

Cost-Effectiveness of Telehealth Solutions

The cost-effectiveness of telehealth solutions is emerging as a crucial driver for the telemedicine market in the UK. By reducing the need for physical infrastructure and minimizing travel costs for patients, telemedicine offers a financially viable alternative to traditional healthcare models. Studies suggest that telemedicine can reduce healthcare costs by up to 20%, making it an attractive option for both patients and providers. This financial incentive is particularly appealing to the National Health Service (NHS), which is exploring ways to optimize resource allocation while maintaining high-quality care. As the telemedicine market continues to evolve, the emphasis on cost savings is likely to attract more stakeholders, further driving market growth and innovation.

Technological Advancements in Communication

Technological advancements are playing a pivotal role in the evolution of the telemedicine market. Innovations in communication technologies, such as high-speed internet and mobile applications, are facilitating seamless interactions between healthcare providers and patients. The integration of secure video conferencing tools and mobile health applications has made it easier for patients to access medical advice from the comfort of their homes. Recent statistics indicate that over 40% of healthcare providers in the UK have adopted telemedicine solutions, reflecting a significant shift in service delivery. This trend is expected to continue as technology evolves, potentially leading to a more interconnected healthcare ecosystem. The telemedicine market is thus positioned to benefit from these advancements, enhancing the overall efficiency and effectiveness of healthcare services.

Growing Acceptance Among Healthcare Professionals

The growing acceptance among healthcare professionals is a key driver for the telemedicine market in the UK. As more practitioners recognize the benefits of telehealth, including improved patient access and enhanced workflow efficiency, the adoption of telemedicine solutions is increasing. Surveys indicate that approximately 70% of healthcare providers are now open to using telemedicine as part of their practice. This shift in mindset is crucial for the sustainability of the telemedicine market, as it fosters collaboration between patients and providers. Furthermore, as training and resources become more readily available, the integration of telemedicine into everyday practice is likely to become more seamless, further propelling market growth.