UK Swimming Pool Treatment Chemicals Market Summary

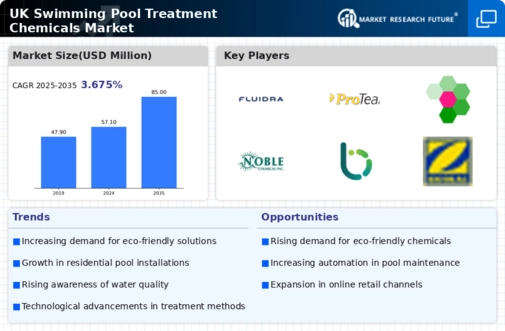

As per Market Research Future analysis, the UK swimming pool-treatment-chemicals market size was estimated at 57.15 USD Million in 2024. The UK swimming pool-treatment-chemicals market is projected to grow from 57.92 USD Million in 2025 to 66.24 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 1.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The UK swimming pool-treatment-chemicals market is experiencing a shift towards sustainability and technological innovation.

- Sustainability initiatives are becoming increasingly prominent, reflecting a broader consumer demand for eco-friendly products.

- Technological advancements in pool maintenance are enhancing efficiency and user experience, driving market growth.

- Increased consumer education regarding pool care is fostering a more informed customer base, leading to higher product adoption rates.

- Rising health awareness and regulatory compliance are key drivers propelling the demand for swimming pool-treatment chemicals.

Market Size & Forecast

| 2024 Market Size | 57.15 (USD Million) |

| 2035 Market Size | 66.24 (USD Million) |

| CAGR (2025 - 2035) | 1.35% |

Major Players

BASF SE (DE), Clorox Company (US), Haviland Enterprises Inc (US), Lonza Group AG (CH), Olin Corporation (US), Pool Corporation (US), SABIC (SA), Solvay SA (BE), United Chemical Company (RU)