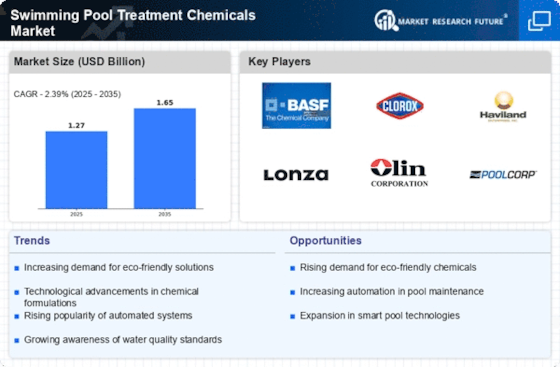

Growth of the Hospitality Sector

The expansion of the hospitality sector, including hotels, resorts, and recreational facilities, is a key driver of the Swimming Pool Treatment Chemicals Market. As the number of establishments offering swimming pools increases, so does the demand for effective treatment solutions to maintain water quality. The hospitality industry is particularly focused on providing safe and enjoyable experiences for guests, which necessitates the use of high-quality treatment chemicals. Industry expert's suggest that the growth in tourism and leisure activities is likely to further boost the demand for swimming pool treatment chemicals. This trend indicates a robust market potential as hospitality businesses prioritize pool maintenance to enhance customer satisfaction.

Rising Demand for Residential Pools

The increasing trend of homeownership and the desire for personal leisure spaces have led to a surge in the construction of residential swimming pools. This trend appears to be driving the Swimming Pool Treatment Chemicals Market, as homeowners seek to maintain their pools effectively. According to recent estimates, the number of residential pools has grown significantly, leading to a corresponding rise in the demand for treatment chemicals. As more individuals invest in their private swimming facilities, the need for effective chemical solutions to ensure water quality and safety becomes paramount. This growing consumer base is likely to propel the market forward, as homeowners prioritize the maintenance of their pools to enhance their recreational experience.

Increased Awareness of Water Quality

There is a notable increase in public awareness regarding the importance of water quality in swimming pools. This heightened consciousness is influencing consumer behavior and driving the Swimming Pool Treatment Chemicals Market. Individuals are becoming more informed about the health risks associated with poor water quality, such as skin irritations and infections. Consequently, there is a growing demand for effective treatment solutions that ensure clean and safe swimming environments. Market data suggests that consumers are willing to invest in high-quality chemicals to maintain optimal water conditions, thereby fostering growth in the treatment chemicals sector. This trend indicates a shift towards prioritizing health and safety in recreational swimming.

Regulatory Compliance and Safety Standards

The Swimming Pool Treatment Chemicals Market is significantly influenced by the establishment of stringent regulatory compliance and safety standards. Governments and health organizations are increasingly implementing regulations to ensure the safety of swimming pool water, which directly impacts the demand for treatment chemicals. Pool operators and homeowners are compelled to adhere to these regulations, leading to a heightened need for effective chemical solutions that meet safety standards. Market data indicates that compliance with these regulations is driving the sales of specific treatment chemicals, as consumers seek products that are certified and proven to maintain safe water conditions. This regulatory landscape is likely to shape the future of the market.

Technological Advancements in Treatment Solutions

The Swimming Pool Treatment Chemicals Market is experiencing a transformation due to technological advancements in chemical formulations and application methods. Innovations such as automated dosing systems and advanced filtration technologies are enhancing the efficiency of chemical use in pool maintenance. These advancements not only improve the effectiveness of treatment chemicals but also reduce the overall chemical consumption, appealing to environmentally conscious consumers. Market analysis indicates that the integration of smart technologies in pool management is likely to drive demand for specialized treatment chemicals that complement these systems. As technology continues to evolve, the market is expected to adapt, leading to new opportunities for growth.