Regulatory Compliance Requirements

The UK security orchestration automation response market industry is heavily influenced by stringent regulatory compliance requirements. Organizations are mandated to adhere to various regulations, such as the General Data Protection Regulation (GDPR) and the Network and Information Systems (NIS) Regulations. These regulations necessitate robust security measures to protect personal and sensitive information. As a result, companies are increasingly investing in security orchestration and automation solutions to ensure compliance and avoid hefty fines. The market is projected to grow as businesses recognize the importance of aligning their security operations with regulatory standards, thereby enhancing their overall security posture.

Increased Adoption of Cloud Services

The shift towards cloud computing is significantly impacting the UK security orchestration automation response market industry. As organizations migrate their operations to the cloud, they face new security challenges that require innovative solutions. The demand for security orchestration and automation tools is rising as businesses seek to secure their cloud environments effectively. Recent statistics indicate that over 70% of UK enterprises are utilizing cloud services, creating a pressing need for integrated security solutions. This trend is likely to drive the growth of the market, as organizations prioritize the protection of their cloud-based assets and data.

Integration of Advanced Technologies

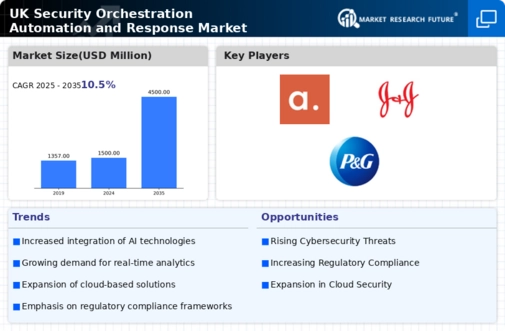

The integration of advanced technologies, such as artificial intelligence and machine learning, is transforming the UK security orchestration automation response market industry. These technologies enable organizations to automate threat detection and response processes, thereby improving efficiency and reducing response times. The market is witnessing a growing interest in solutions that leverage AI-driven analytics to enhance security operations. As organizations seek to stay ahead of evolving threats, the adoption of these advanced technologies is expected to accelerate, further propelling the growth of the security orchestration automation response market.

Growing Cybersecurity Threat Landscape

The UK security orchestration automation response market industry is experiencing a surge in demand due to the escalating cybersecurity threats. With the increasing sophistication of cyberattacks, organizations are compelled to adopt advanced security measures. According to recent data, the UK has witnessed a 30% rise in reported cyber incidents over the past year. This alarming trend necessitates the implementation of security orchestration and automation solutions to enhance incident response capabilities. As businesses strive to protect sensitive data and maintain operational integrity, the market for security orchestration automation response solutions is expected to expand significantly, driven by the urgent need for effective threat mitigation strategies.

Rising Demand for Incident Response Solutions

The UK security orchestration automation response market industry is witnessing a rising demand for incident response solutions. Organizations are increasingly recognizing the importance of having a well-defined incident response strategy to address potential security breaches effectively. The need for rapid response capabilities is underscored by the growing number of cyber incidents, prompting businesses to invest in security orchestration and automation tools. This trend is likely to continue as organizations strive to enhance their resilience against cyber threats, thereby driving the growth of the market for incident response solutions.