Rising Demand for Biologic Therapies

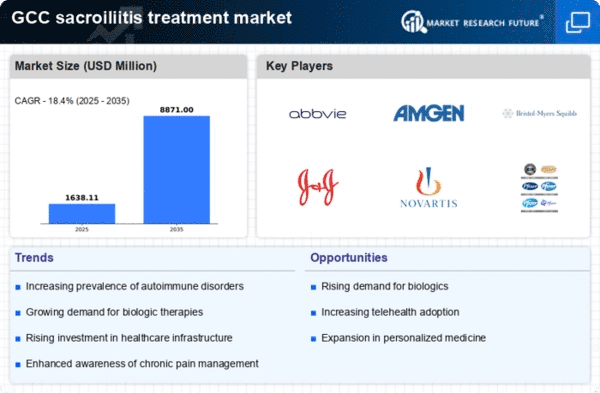

The shift towards biologic therapies in the treatment of inflammatory conditions is significantly influencing the sacroiliitis treatment market. Biologics, which target specific pathways in the immune system, have shown promising results in managing sacroiliitis symptoms. The market for biologic drugs in the GCC is expected to grow at a CAGR of 15-20% over the next five years. This trend is driven by the increasing recognition of the efficacy of biologics compared to traditional therapies. As healthcare providers in the region adopt these advanced treatment options, the demand for biologic therapies in the sacroiliitis treatment market is likely to rise, reflecting a broader shift in treatment paradigms.

Increasing Prevalence of Autoimmune Disorders

The rising incidence of autoimmune disorders in the GCC region is a significant driver for the sacroiliitis treatment market. Conditions such as ankylosing spondylitis and psoriatic arthritis, which often lead to sacroiliitis, are becoming more prevalent. Recent studies indicate that autoimmune diseases affect approximately 5-10% of the population in GCC countries. This growing patient population necessitates effective treatment options, thereby expanding the market. Healthcare providers are increasingly focusing on early diagnosis and management of these conditions, which is likely to boost demand for therapies targeting sacroiliitis. As awareness of these disorders increases, the need for specialized treatments will likely grow, further propelling the sacroiliitis treatment market in the region.

Technological Advancements in Diagnostic Tools

Innovations in diagnostic technologies are transforming the landscape of the sacroiliitis treatment market. Advanced imaging techniques, such as MRI and CT scans, enable healthcare professionals to diagnose sacroiliitis more accurately and at earlier stages. The introduction of these technologies has been associated with a 20-30% increase in diagnosis rates in the GCC region. Enhanced diagnostic capabilities not only facilitate timely treatment but also improve patient outcomes, which is crucial for chronic conditions like sacroiliitis. As healthcare facilities in the GCC continue to adopt these advanced tools, the demand for effective treatment options is expected to rise, thereby driving growth in the sacroiliitis treatment market.

Enhanced Patient Education and Support Programs

The establishment of patient education and support programs is emerging as a crucial driver for the sacroiliitis treatment market. These initiatives aim to inform patients about their condition, treatment options, and self-management strategies. Increased patient knowledge can lead to better adherence to treatment regimens and improved health outcomes. In the GCC, healthcare organizations are increasingly implementing these programs, which may contribute to a 10-15% increase in treatment compliance among patients with sacroiliitis. As patients become more engaged in their healthcare, the demand for effective treatment options is likely to grow, thereby positively impacting the sacroiliitis treatment market.

Growing Investment in Healthcare Infrastructure

The GCC region is witnessing substantial investments in healthcare infrastructure, which is a key driver for the sacroiliitis treatment market. Governments are prioritizing healthcare development, leading to the establishment of advanced medical facilities and specialized clinics. This investment is projected to increase healthcare spending by approximately 10-15% annually over the next few years. Improved access to healthcare services allows for better diagnosis and treatment of conditions like sacroiliitis. As more healthcare facilities become equipped with the latest treatment modalities, the market for sacroiliitis treatment is likely to expand, catering to a larger patient base.