Government Initiatives and Funding

Government initiatives and funding are pivotal in supporting the rapid diagnostics market in the UK. The UK government has been actively investing in healthcare infrastructure and research, particularly in the field of diagnostics. This support is aimed at enhancing the capabilities of healthcare systems to respond to emerging health threats. Recent funding allocations have focused on developing rapid testing solutions, which are essential for effective disease management. Such initiatives not only bolster the rapid diagnostics market but also encourage collaboration between public and private sectors, fostering innovation and improving healthcare delivery.

Growing Focus on Preventive Healthcare

The growing focus on preventive healthcare is significantly influencing the rapid diagnostics market. As healthcare systems in the UK shift towards preventive measures, the demand for rapid diagnostic tests is expected to rise. These tests facilitate early detection of diseases, allowing for timely interventions that can prevent complications and reduce healthcare costs. The emphasis on preventive healthcare aligns with national health policies aimed at improving population health outcomes. Consequently, the rapid diagnostics market is likely to benefit from this trend, as more healthcare providers adopt rapid testing solutions to support preventive strategies.

Increasing Demand for Timely Diagnosis

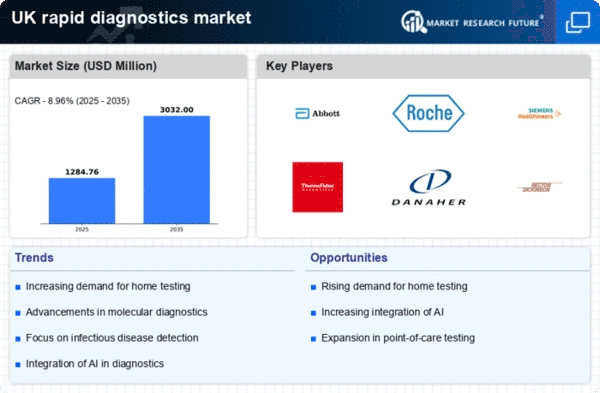

The rapid diagnostics market in the UK is experiencing a surge in demand for timely and accurate diagnostic solutions. This trend is driven by the growing awareness among healthcare providers and patients regarding the importance of early disease detection. The ability to obtain results quickly can significantly influence treatment decisions, thereby improving patient outcomes. According to recent data, the market is projected to grow at a CAGR of approximately 10% over the next five years. This increasing demand is likely to encourage innovation and investment in the rapid diagnostics market, as stakeholders seek to develop more efficient and effective testing methods.

Rising Prevalence of Infectious Diseases

The rapid diagnostics market is significantly impacted by the rising prevalence of infectious diseases in the UK. With the increasing incidence of conditions such as respiratory infections and sexually transmitted diseases, there is a pressing need for rapid testing solutions. The UK government has reported a notable increase in the number of reported cases, which has led to heightened public health initiatives aimed at controlling outbreaks. This situation creates a favorable environment for the rapid diagnostics market, as healthcare providers require efficient tools to diagnose and manage these diseases promptly. The market is expected to expand as a result of this growing need.

Technological Innovations in Diagnostic Tools

Technological innovations are playing a crucial role in shaping the rapid diagnostics market. Advancements in molecular diagnostics, biosensors, and microfluidics are enabling the development of more sophisticated and user-friendly testing devices. These innovations not only enhance the accuracy and speed of diagnostics but also reduce costs, making them more accessible to healthcare facilities across the UK. The integration of artificial intelligence and machine learning into diagnostic processes is also emerging, potentially transforming the landscape of the rapid diagnostics market. As these technologies continue to evolve, they are likely to drive further growth and adoption in the sector.