Growing Threat Landscape

The railway cybersecurity market in Spain is experiencing heightened concern due to an evolving threat landscape. Cyberattacks targeting critical infrastructure have surged, with reports indicating a 30% increase in incidents over the past year. This alarming trend compels railway operators to invest in robust cybersecurity measures to safeguard their systems. The potential for disruptions in service and safety breaches drives the demand for advanced cybersecurity solutions. As a result, stakeholders are prioritizing investments in technologies that can mitigate risks associated with cyber threats. The growing threat landscape is thus a significant driver for the railway cybersecurity market, as organizations seek to protect their assets and ensure the safety of passengers.

Government Initiatives and Funding

In Spain, government initiatives aimed at enhancing cybersecurity in the railway sector are playing a crucial role in shaping the railway cybersecurity market. The Spanish government has allocated approximately €100 million for cybersecurity projects in transportation, reflecting a commitment to bolster national security. These initiatives often include funding for research and development of innovative cybersecurity technologies. Furthermore, collaboration with private sector entities is encouraged to foster a comprehensive approach to cybersecurity. This governmental support not only stimulates market growth but also ensures that railway operators are equipped with the necessary resources to implement effective cybersecurity measures. Consequently, government initiatives and funding are pivotal drivers in the railway cybersecurity market.

Rising Public Awareness of Cybersecurity

Public awareness regarding cybersecurity threats has significantly increased in Spain, influencing the railway cybersecurity market. As incidents of cyberattacks gain media attention, passengers and stakeholders alike are becoming more conscious of the potential risks associated with railway operations. This heightened awareness is prompting railway operators to prioritize cybersecurity measures to maintain public trust and ensure safety. Surveys indicate that over 70% of passengers express concerns about cybersecurity in transportation, leading to increased pressure on operators to implement robust security protocols. Consequently, the rising public awareness of cybersecurity is a vital driver for the railway cybersecurity market, as it compels organizations to take proactive steps in safeguarding their systems.

Increased Investment in Infrastructure Modernization

The railway sector in Spain is undergoing significant modernization, which inherently increases the need for enhanced cybersecurity measures. As railway operators invest in upgrading their infrastructure, including the integration of IoT devices and automated systems, the potential vulnerabilities also rise. Reports suggest that investments in railway infrastructure are expected to reach €5 billion by 2027, with a substantial portion allocated to cybersecurity enhancements. This modernization trend necessitates the implementation of advanced cybersecurity protocols to protect against potential cyber threats. Therefore, the increased investment in infrastructure modernization serves as a critical driver for the railway cybersecurity market, as stakeholders recognize the importance of securing their evolving systems.

Technological Advancements in Cybersecurity Solutions

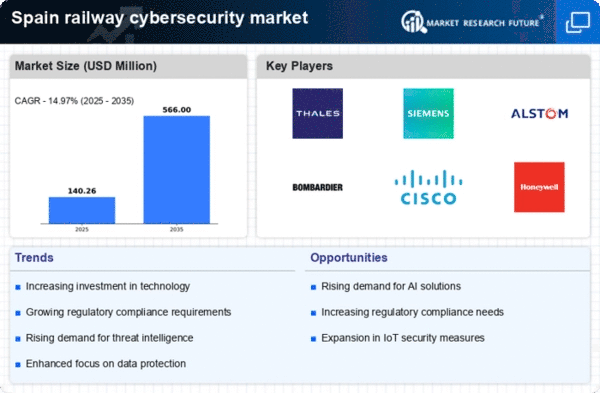

The railway cybersecurity market in Spain is being propelled by rapid technological advancements in cybersecurity solutions. Innovations such as artificial intelligence, machine learning, and blockchain technology are being integrated into cybersecurity frameworks, enhancing the ability to detect and respond to threats. The market for cybersecurity solutions is projected to grow by 15% annually, driven by the demand for more sophisticated protection mechanisms. These advancements not only improve the efficiency of threat detection but also reduce response times, thereby minimizing potential damages from cyber incidents. As a result, the continuous evolution of technology in cybersecurity solutions is a significant driver for the railway cybersecurity market, as organizations strive to stay ahead of emerging threats.