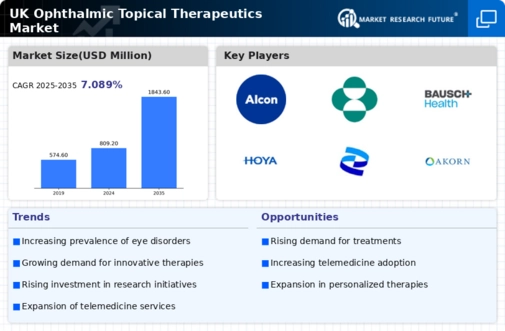

Advancements in Telemedicine

The integration of telemedicine into the UK healthcare system is transforming the landscape of the ophthalmic topical therapeutics market. Telemedicine facilitates remote consultations and follow-ups, allowing patients to access eye care services more conveniently. This trend is particularly beneficial for individuals with mobility issues or those residing in remote areas. As telemedicine becomes more prevalent, it is expected to enhance patient adherence to treatment regimens, as patients can easily consult with healthcare professionals regarding their therapeutic options. This shift towards digital healthcare solutions may lead to an increase in the utilization of topical therapeutics, as patients are more likely to seek timely interventions for their eye conditions.

Increased Awareness and Education

There is a growing awareness and education regarding eye health among the UK population, which is positively impacting the ophthalmic topical therapeutics market. Public health campaigns and initiatives by organizations such as the Royal National Institute of Blind People (RNIB) are educating individuals about the importance of regular eye examinations and early intervention for eye disorders. This heightened awareness is leading to increased patient engagement and a proactive approach to eye care. As more individuals seek treatment for their eye conditions, the demand for effective topical therapeutics is expected to rise. Consequently, healthcare providers are likely to prioritize the availability of innovative therapies to meet this growing demand.

Rising Prevalence of Eye Disorders

The UK ophthalmic topical therapeutics market is experiencing growth due to the increasing prevalence of eye disorders such as glaucoma, dry eye syndrome, and age-related macular degeneration. According to the National Health Service (NHS), millions of individuals in the UK are affected by these conditions, leading to a heightened demand for effective therapeutic solutions. The aging population further exacerbates this issue, as older adults are more susceptible to various ocular diseases. Consequently, pharmaceutical companies are focusing on developing innovative topical treatments to address these challenges, thereby driving market expansion. The rising incidence of eye disorders necessitates a robust pipeline of ophthalmic therapeutics, which is likely to enhance patient outcomes and improve quality of life for those affected.

Regulatory Support for Innovative Therapies

The UK ophthalmic topical therapeutics market benefits from a regulatory framework that supports the development and approval of innovative therapies. The Medicines and Healthcare products Regulatory Agency (MHRA) plays a pivotal role in ensuring that new ophthalmic products meet safety and efficacy standards. Recent initiatives aimed at expediting the approval process for novel therapies are likely to encourage pharmaceutical companies to invest in the development of groundbreaking treatments. This regulatory support not only fosters innovation but also enhances patient access to advanced therapeutics. As a result, the market is poised for growth, with an increasing number of innovative ophthalmic products entering the market to address diverse patient needs.

Growing Investment in Research and Development

Investment in research and development (R&D) within the UK ophthalmic topical therapeutics market is on the rise, as companies strive to innovate and improve existing therapies. The UK government has been supportive of R&D initiatives, providing funding and incentives for pharmaceutical firms to explore novel drug formulations and delivery systems. This investment is crucial for the development of advanced therapies that can effectively treat complex eye conditions. Furthermore, collaborations between academic institutions and industry players are fostering a conducive environment for innovation. As a result, the market is likely to witness the introduction of cutting-edge products that address unmet medical needs, thereby enhancing the overall therapeutic landscape.