Growing Cybersecurity Threats

The network telemetry market is increasingly driven by the growing cybersecurity threats faced by organizations in the UK. As cyberattacks become more sophisticated, businesses are recognizing the necessity of implementing advanced telemetry solutions to enhance their security posture. The market is projected to expand as companies invest in tools that provide real-time monitoring and threat detection capabilities. In 2025, it is estimated that cybercrime will cost the UK economy over £50 billion annually, underscoring the urgency for effective cybersecurity measures. Telemetry solutions enable organizations to analyze network traffic, identify vulnerabilities, and respond swiftly to potential threats. Consequently, the rising incidence of cyber threats is a crucial driver for the network telemetry market, as firms prioritize investments in technologies that safeguard their digital assets.

Expansion of Cloud-Based Solutions

The network telemetry market is witnessing a significant expansion of cloud-based solutions, which offer scalable and flexible options for data management. As UK businesses increasingly migrate to cloud infrastructures, the demand for telemetry tools that can seamlessly integrate with these environments is on the rise. This shift is reflected in the market, with cloud-based telemetry solutions expected to account for over 40% of total market revenue by 2026. The advantages of cloud computing, such as reduced operational costs and enhanced accessibility, are compelling organizations to adopt these technologies. Furthermore, the ability to analyze telemetry data in real-time from any location enhances collaboration and decision-making processes. Thus, the proliferation of cloud-based solutions is a critical driver for the network telemetry market, enabling businesses to harness the full potential of their data.

Advancements in Network Infrastructure

The network telemetry market is benefiting from advancements in network infrastructure, particularly with the rollout of 5G technology across the UK. The introduction of 5G networks is expected to enhance data transmission speeds and increase the volume of data generated, thereby creating a greater need for telemetry solutions. As organizations adapt to these advancements, they require sophisticated tools to monitor and analyze network performance effectively. The market is anticipated to grow as businesses seek to leverage the capabilities of 5G to improve operational efficiency and customer experiences. Furthermore, the integration of next-generation technologies, such as edge computing, is likely to further drive the demand for telemetry solutions. Thus, the evolution of network infrastructure serves as a vital driver for the network telemetry market, enabling organizations to harness the benefits of enhanced connectivity.

Rising Demand for Real-Time Data Analysis

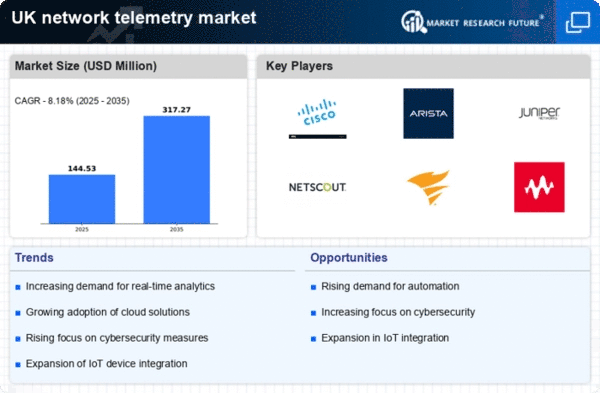

The network telemetry market is experiencing a notable surge in demand for real-time data analysis. As businesses increasingly rely on instantaneous insights to drive decision-making, the need for advanced telemetry solutions becomes paramount. In the UK, the market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the necessity for enhanced operational efficiency. Companies are seeking to leverage telemetry data to monitor network performance, identify anomalies, and optimize resource allocation. This trend indicates a shift towards proactive network management, where organizations can anticipate issues before they escalate. Consequently, the network telemetry market is positioned to benefit from this growing emphasis on real-time analytics, as firms invest in technologies that facilitate immediate data processing and visualization.

Increased Regulatory Compliance Requirements

the network telemetry market is influenced by increasing regulatory compliance requirements for UK businesses.. With the introduction of stringent data protection laws, such as the General Data Protection Regulation (GDPR), organizations are compelled to adopt robust telemetry solutions to ensure compliance. This regulatory landscape necessitates the implementation of advanced monitoring systems that can track data flows and identify potential breaches. As a result, the market is expected to grow as companies invest in telemetry tools that facilitate compliance reporting and risk management. The financial implications are substantial, with non-compliance potentially leading to fines of up to £17.5 million or 4% of annual global turnover. Therefore, the heightened focus on regulatory compliance is a pivotal driver for the network telemetry market, as businesses seek to mitigate risks and protect sensitive information.