Growing Regulatory Pressures

In France, the network telemetry market faces increasing regulatory pressures that compel organizations to adopt comprehensive monitoring solutions. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), necessitates robust telemetry systems to ensure data integrity and security. Companies are required to monitor their networks continuously to detect and respond to potential breaches. This regulatory landscape is expected to drive the market for network telemetry solutions, as organizations invest in technologies that facilitate compliance. The network telemetry market industry is likely to see a rise in demand for solutions that not only meet regulatory requirements but also enhance overall network security and performance.

Expansion of Cloud-Based Solutions

The shift towards cloud-based solutions significantly influences the network telemetry market in France. As organizations migrate their operations to the cloud, the need for effective network monitoring and telemetry becomes paramount. Cloud environments require robust telemetry solutions to ensure performance, security, and compliance. The market for cloud services in France is expected to reach €10 billion by 2026, indicating a strong growth trajectory. This expansion necessitates advanced telemetry tools that can seamlessly integrate with cloud infrastructures. As a result, the network telemetry market industry is likely to see increased demand for solutions that provide visibility and control over cloud-based networks, enabling organizations to maintain optimal performance and security.

Advancements in Network Infrastructure

The ongoing advancements in network infrastructure significantly impact the network telemetry market in France. The rollout of 5G technology and the expansion of fiber-optic networks create new opportunities for telemetry solutions. These advancements enable higher data transfer rates and improved connectivity, which are essential for effective network monitoring. As organizations upgrade their infrastructure, the demand for sophisticated telemetry tools that can handle increased data volumes and provide actionable insights is likely to rise. The network telemetry market industry is expected to benefit from these technological advancements, as businesses seek to leverage enhanced network capabilities for improved operational efficiency and customer satisfaction.

Rising Demand for Real-Time Data Analysis

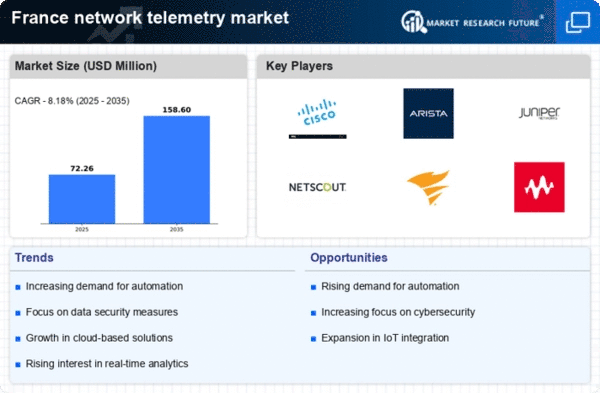

The network telemetry market in France experiences a notable surge in demand for real-time data analysis. Organizations increasingly recognize the value of immediate insights derived from network data, which enhances decision-making processes. This trend is particularly evident in sectors such as finance and telecommunications, where timely information can lead to competitive advantages. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 25% over the next five years. This growth is likely to drive investments in network telemetry solutions, as businesses seek to optimize their operations and improve service delivery. Consequently, the network telemetry market industry is poised to benefit from this heightened focus on real-time data capabilities, as companies strive to leverage telemetry data for operational efficiency.

Increased Focus on Network Performance Optimization

The network telemetry market in France is witnessing a heightened focus on network performance optimization. Organizations are increasingly aware of the impact of network performance on overall business operations. As a result, there is a growing demand for telemetry solutions that provide insights into network health, traffic patterns, and potential bottlenecks. This trend is particularly relevant in industries such as e-commerce and online services, where network performance directly affects customer experience. The network telemetry market industry is likely to see a surge in investments aimed at optimizing network performance, as companies strive to enhance service delivery and maintain a competitive edge.