Regulatory Compliance and Standards

The mortuary equipment market is significantly influenced by stringent regulatory frameworks and standards governing the handling of deceased individuals. In the UK, compliance with health and safety regulations, as well as environmental guidelines, is paramount for mortuary service providers. This necessitates the acquisition of equipment that meets these legal requirements, such as embalming tools, refrigeration units, and body transport systems. As regulations evolve, there is a growing need for manufacturers to ensure their products align with these standards, thereby driving innovation and quality improvements in the market. The emphasis on compliance not only enhances operational efficiency but also instills confidence among consumers regarding the safety and integrity of mortuary services.

Increasing Demand for Cremation Services

The rising preference for cremation over traditional burial methods is a notable driver in the mortuary equipment market. In the UK, cremation rates have surged, with approximately 80% of deceased individuals being cremated in recent years. This shift necessitates the procurement of specialized cremation equipment, such as cremators and associated technologies. As families seek more cost-effective and environmentally friendly options, the demand for cremation-related equipment is likely to continue its upward trajectory. This trend not only influences the types of equipment required but also encourages manufacturers to innovate and enhance their offerings to meet evolving consumer preferences. Consequently, the mortuary equipment market is experiencing a transformation, with a clear focus on catering to the needs of cremation service providers.

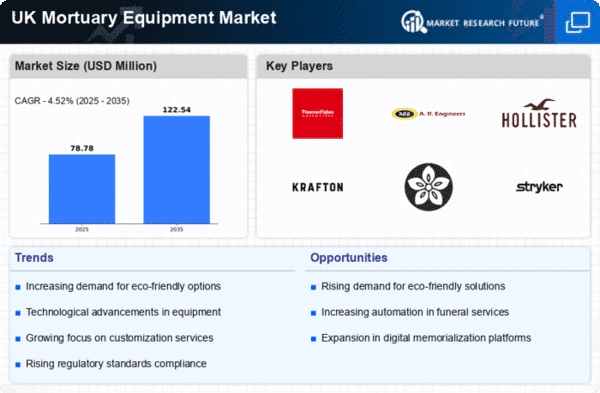

Growing Awareness of Eco-Friendly Practices

The rising awareness of environmental issues is influencing the mortuary equipment market, particularly in the context of eco-friendly practices. In the UK, there is a growing demand for sustainable options, such as biodegradable caskets and environmentally responsible cremation methods. This shift towards sustainability is prompting mortuary service providers to seek equipment that aligns with these values. As consumers become more conscious of their environmental impact, the mortuary equipment market is likely to see an increase in the availability of eco-friendly products. Manufacturers are responding to this trend by developing innovative solutions that minimize environmental footprints, thereby catering to the preferences of a more environmentally aware clientele. This focus on sustainability not only enhances the market's appeal but also positions it for future growth.

Aging Population and Increased Mortality Rates

The demographic shift towards an aging population in the UK is a critical driver for the mortuary equipment market. As the proportion of elderly individuals rises, so does the demand for mortuary services and, consequently, the equipment required to support these services. Projections indicate that by 2030, the number of individuals aged 65 and over will increase significantly, leading to higher mortality rates. This demographic trend compels mortuary service providers to invest in advanced equipment to accommodate the growing number of deceased individuals. The increased demand for services translates into a robust market for mortuary equipment, as providers seek to enhance their operational capabilities and meet the needs of families during challenging times.

Technological Integration in Mortuary Services

The integration of advanced technologies into mortuary services is reshaping the landscape of the mortuary equipment market. Innovations such as digital record-keeping, automated embalming systems, and advanced refrigeration technologies are becoming increasingly prevalent. These technologies not only streamline operations but also improve the overall quality of services provided. In the UK, the adoption of such technologies is driven by the need for efficiency and enhanced customer experience. As mortuary service providers seek to differentiate themselves in a competitive market, the demand for technologically advanced equipment is likely to rise. This trend indicates a shift towards modernizing traditional practices, thereby creating opportunities for manufacturers to develop innovative solutions tailored to the evolving needs of the industry.