Increasing Generic Competition

The montelukast intermediate market is witnessing a surge in generic competition as patents for branded montelukast products expire. This shift is leading to a decrease in prices, making montelukast more accessible to patients across the UK. The entry of generic manufacturers into the market is expected to increase the volume of montelukast intermediates produced, as these companies seek to capitalize on the growing demand for affordable asthma treatments. According to market analysis, the generic segment is projected to capture a significant share of the montelukast intermediate market, potentially reaching a market share of over 50% by 2027. This competitive landscape is likely to drive innovation and efficiency among manufacturers.

Focus on Patient-Centric Healthcare

The montelukast intermediate market is increasingly influenced by the focus on patient-centric healthcare in the UK. Healthcare providers are prioritizing treatments that improve patient quality of life, particularly for those suffering from chronic conditions like asthma. This shift towards personalized medicine encourages the development of montelukast formulations that cater to specific patient needs, such as different age groups or co-existing health conditions. Additionally, patient education initiatives are being implemented to enhance understanding of asthma management, which may lead to higher adherence rates to montelukast therapy. Consequently, the montelukast intermediate market is likely to expand as manufacturers align their products with the evolving demands of patient-centric care.

Rising Demand for Asthma Treatments

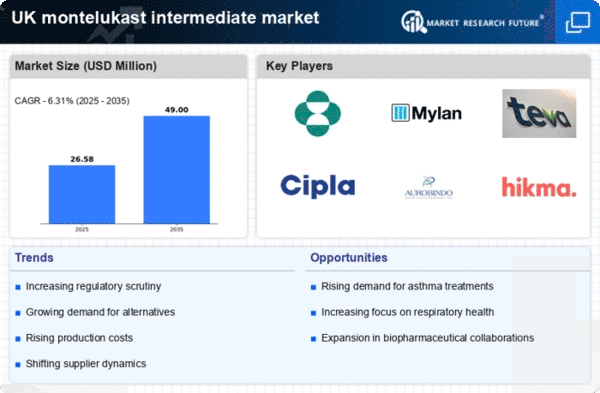

The montelukast intermediate market is experiencing a notable increase in demand due to the rising prevalence of asthma and allergic rhinitis in the UK. Recent statistics indicate that approximately 8.5% of adults and 12% of children in the UK are diagnosed with asthma, leading to a growing need for effective treatments. Montelukast, as a leukotriene receptor antagonist, plays a crucial role in managing these conditions. The increasing awareness of asthma management and the importance of adherence to treatment regimens further drive the market. Consequently, pharmaceutical companies are focusing on the production of montelukast intermediates to meet this escalating demand, thereby enhancing their market presence in the montelukast intermediate market.

Regulatory Support for Drug Approvals

Regulatory support for drug approvals is a critical factor influencing the montelukast intermediate market. The UK Medicines and Healthcare products Regulatory Agency (MHRA) has streamlined processes for the approval of new drugs and intermediates, which encourages pharmaceutical companies to invest in the development of montelukast-related products. This supportive regulatory environment is likely to expedite the entry of new montelukast formulations into the market, enhancing competition and availability. Furthermore, the MHRA's commitment to ensuring drug safety and efficacy fosters consumer confidence, which may lead to increased prescriptions of montelukast products. As a result, the montelukast intermediate market is poised for growth driven by regulatory facilitation.

Investment in Research and Development

Investment in research and development (R&D) is a significant driver for the montelukast intermediate market. Pharmaceutical companies in the UK are allocating substantial resources to innovate and improve montelukast formulations. This focus on R&D aims to enhance the efficacy and safety profiles of montelukast, which could lead to the development of new delivery methods or combination therapies. The UK government has been supportive of R&D initiatives, providing funding and incentives for companies engaged in pharmaceutical innovation. As a result, the montelukast intermediate market is likely to benefit from advancements that could expand its applications and improve patient outcomes, thereby stimulating market growth.