Growing Demand for Convenience

The Mobile POS Market is experiencing a notable surge in demand for convenience among consumers and businesses alike. As shopping habits evolve, customers increasingly prefer seamless and efficient payment solutions. This trend is particularly evident in the UK, where a significant % of consumers express a preference for mobile payment options that facilitate quick transactions. Retailers are responding by adopting mobile pos systems to enhance customer experience, thereby driving growth in the mobile pos market. The convenience factor is further amplified by the rise of on-the-go shopping, where consumers expect to complete purchases swiftly, often through their smartphones. Consequently, businesses that integrate mobile pos solutions are likely to attract a broader customer base, ultimately contributing to the expansion of the mobile pos market in the UK.

Shift Towards Cashless Transactions

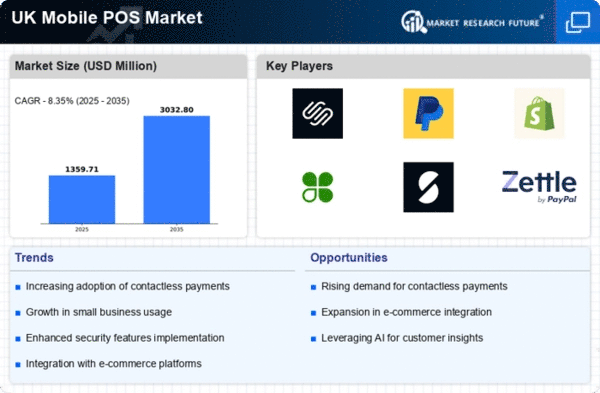

The shift towards cashless transactions is a significant driver of the Mobile POS Market. In the UK, a growing % of consumers are opting for digital payment methods over traditional cash transactions. This trend is supported by government initiatives promoting cashless economies, which encourage businesses to adopt mobile pos systems. As a result, retailers are increasingly investing in mobile payment solutions to cater to this evolving consumer preference. The convenience and speed of mobile transactions are appealing to both consumers and businesses, leading to a projected growth rate of approximately 25% in the mobile pos market over the next few years. This transition not only enhances customer satisfaction but also streamlines operational processes for businesses, further solidifying the role of mobile pos systems in the retail landscape.

Increased Focus on Customer Experience

An increased focus on customer experience is driving the Mobile POS Market in the UK. Businesses are recognizing the importance of providing a seamless and engaging shopping experience to retain customers. Mobile pos systems enable retailers to offer personalized services, such as tailored promotions and loyalty programs, directly at the point of sale. This approach not only enhances customer satisfaction but also fosters brand loyalty. In the competitive retail environment, companies that prioritize customer experience through mobile pos solutions are likely to gain a competitive edge. As a result, the mobile pos market is expected to grow as businesses invest in technologies that enhance customer interactions and streamline the purchasing process.

Regulatory Support for Digital Payments

Regulatory support for digital payments is emerging as a crucial driver for the Mobile POS Market. In the UK, government policies are increasingly favoring the adoption of digital payment solutions, which include mobile pos systems. Initiatives aimed at enhancing financial inclusion and promoting secure payment methods are encouraging businesses to transition from traditional payment systems. This regulatory environment is likely to stimulate growth in the mobile pos market, as more retailers seek to comply with evolving standards and consumer expectations. The support from regulatory bodies not only facilitates the adoption of mobile pos solutions but also instills consumer confidence in digital transactions, further propelling the market forward.

Technological Advancements in Payment Solutions

Technological advancements are playing a pivotal role in shaping the Mobile POS Market. Innovations such as near-field communication (NFC) and advanced encryption methods are enhancing the functionality and security of mobile payment systems. In the UK, the adoption of these technologies is evident, with a reported increase in mobile transactions by over 30% in recent years. This growth indicates a strong consumer inclination towards adopting mobile pos solutions that offer enhanced features. Furthermore, the integration of artificial intelligence and machine learning into mobile pos systems is expected to improve transaction efficiency and customer insights. As businesses seek to leverage these technologies, the mobile pos market is likely to witness accelerated growth, driven by the demand for cutting-edge payment solutions.