Focus on Core Competencies

The UK middle office outsourcing market is witnessing a growing emphasis on core competencies as organizations strive to enhance their competitive edge. By outsourcing non-core functions, firms can allocate resources more effectively and concentrate on strategic initiatives. This trend is particularly pronounced among financial institutions, where the complexity of operations necessitates a focus on areas that drive value. Outsourcing middle office functions allows firms to leverage specialized expertise while freeing up internal resources for innovation and growth. As organizations recognize the benefits of concentrating on their core strengths, the demand for outsourcing services is expected to rise. This driver reflects a broader strategic shift within the UK middle office outsourcing market, where firms are increasingly prioritizing efficiency and effectiveness.

Regulatory Compliance Pressures

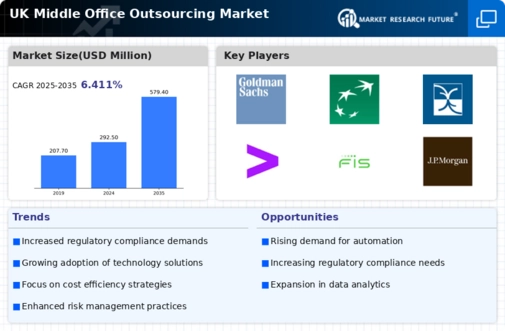

In the UK middle office outsourcing market, regulatory compliance remains a critical driver influencing outsourcing decisions. Financial institutions are subject to stringent regulations, necessitating robust compliance frameworks. Outsourcing middle office functions allows firms to leverage the expertise of specialized providers who are well-versed in regulatory requirements. This trend is particularly relevant in light of the Financial Conduct Authority's ongoing efforts to enhance market integrity and consumer protection. As compliance costs continue to rise, organizations are increasingly turning to outsourcing as a viable strategy to mitigate risks associated with non-compliance. The ability to ensure adherence to regulations while maintaining operational efficiency positions outsourcing as a strategic imperative within the UK middle office outsourcing market.

Growing Demand for Cost Efficiency

The UK middle office outsourcing market is experiencing a notable shift towards cost efficiency as firms seek to optimize their operational expenditures. With increasing pressure to maintain profitability, organizations are increasingly outsourcing middle office functions to specialized service providers. This trend is underscored by a report indicating that outsourcing can reduce operational costs by up to 30 percent. As firms navigate a competitive landscape, the ability to leverage external expertise while minimizing overhead costs becomes paramount. Consequently, the demand for outsourcing services is likely to grow, as companies aim to streamline processes and focus on core competencies. This driver reflects a broader movement within the UK middle office outsourcing market, where financial institutions and corporations are prioritizing cost-effective solutions to enhance their financial performance.

Increased Competition and Market Dynamics

The UK middle office outsourcing market is characterized by heightened competition and evolving market dynamics. As firms seek to differentiate themselves, the pressure to enhance service delivery and operational efficiency intensifies. Outsourcing middle office functions provides organizations with the agility to adapt to changing market conditions while maintaining a competitive edge. The emergence of new players and innovative service models is reshaping the landscape, prompting established firms to reassess their outsourcing strategies. This competitive environment encourages collaboration between organizations and outsourcing providers, fostering innovation and improved service offerings. As competition continues to escalate, the UK middle office outsourcing market is likely to experience sustained growth, driven by the need for organizations to remain agile and responsive to market demands.

Technological Advancements and Automation

The integration of advanced technologies is reshaping the UK middle office outsourcing market. Automation, artificial intelligence, and data analytics are becoming integral to middle office operations, enhancing efficiency and accuracy. As firms seek to harness these technologies, outsourcing partners that offer innovative solutions are gaining traction. A recent survey indicates that 60 percent of financial institutions in the UK are investing in automation to streamline their middle office processes. This technological shift not only reduces manual errors but also enables organizations to respond swiftly to market changes. Consequently, the demand for outsourcing services that incorporate cutting-edge technologies is likely to increase, positioning the UK middle office outsourcing market at the forefront of digital transformation.