The South Korea Middle Office Outsourcing Market is characterized by its dynamic landscape, wherein firms seek to enhance operational efficiency and reduce costs by leveraging specialized outsourcing services for non-core activities. The competitive insights with respect to this market highlight a growing trend among financial institutions, investment firms, and corporates that aim to focus on their core competencies while delegating middle office functions such as trade processing, risk management, compliance, and reporting.

As a result, service providers are continuously innovating their offerings and enhancing their capabilities to meet the evolving demands of clients. The market is driven by advancements in technology, regulatory changes, and the need for greater operational transparency, positioning outsourcing firms as pivotal players in the financial value chain.FSS is positioned prominently within the South Korea Middle Office Outsourcing Market, capitalizing on its extensive experience and robust technological framework.

The company has built a strong reputation for providing comprehensive middle office solutions tailored to the unique needs of the South Korean financial sector. With a focus on regulatory compliance, risk management, and tactical support, FSS leverages its market knowledge and advanced systems to offer high-quality services that cater to the specific demands of its clients. The strength of FSS lies in its ability to integrate innovative technologies, such as automation and analytical tools, that enhance efficiency and accuracy in operational processes.

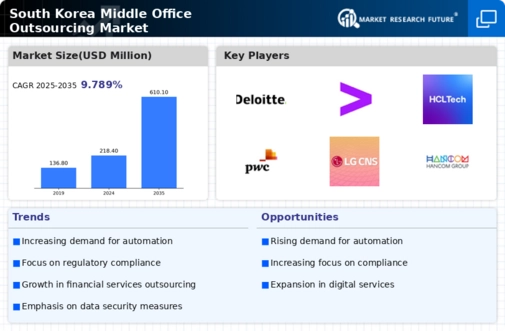

Furthermore, FSS benefits from a solid client base, leading to a competitive advantage through long-term partnerships and a proven track record in delivering reliability.Deloitte stands out in the South Korea Middle Office Outsourcing Market through its comprehensive suite of services encompassing advisory, risk management, and compliance solutions tailored specifically for middle office functions. The company has established a solid market presence in South Korea, where its in-depth understanding of local regulations and business practices plays a crucial role in delivering value to its clients.

Deloitte's strengths lie in its multidisciplinary approach, where it employs a combination of advanced analytics, technological innovations, and domain expertise to drive efficiency and streamline operations. In terms of key products, Deloitte offers customized outsourcing solutions designed to support financial reporting, data management, and regulatory compliance.

Its commitment to growth is reflected in strategic mergers and acquisitions that enhance its offerings and market penetration in South Korea. This capability enables Deloitte to deliver best-in-class services while staying ahead of market trends and evolving client needs, reinforcing its competitive edge in the middle office outsourcing arena.