Innovation in Membrane Materials

The membrane chromatography market is experiencing a surge in innovation related to membrane materials. Advances in polymer science and nanotechnology are leading to the development of membranes with enhanced performance characteristics, such as increased permeability and selectivity. These innovations are crucial for meeting the evolving demands of the biopharmaceutical industry in the UK. For instance, new membrane materials can improve the efficiency of protein purification processes, which is vital as the complexity of biopharmaceutical products increases. This trend towards innovation is expected to drive market growth as manufacturers seek to leverage these advancements.

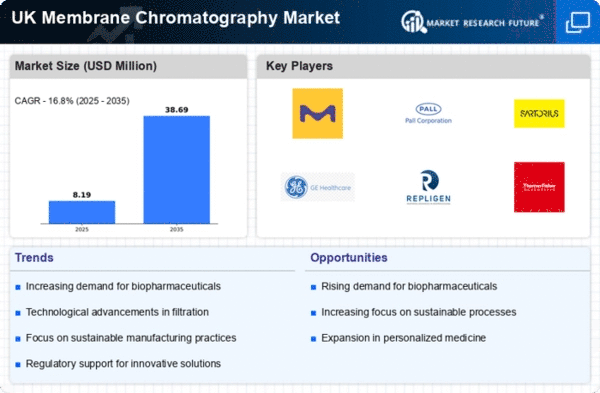

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals in the UK is a primary driver for the membrane chromatography market. As the biopharmaceutical sector expands, the need for efficient purification processes becomes critical. Membrane chromatography offers advantages such as high selectivity and reduced processing times, which are essential for the production of therapeutic proteins and monoclonal antibodies. The UK biopharmaceutical market is projected to reach £25 billion by 2026, indicating a robust growth trajectory. This growth is likely to stimulate investments in advanced purification technologies, including membrane chromatography, thereby enhancing the market's potential.

Increased Focus on Process Automation

The trend towards automation in biopharmaceutical manufacturing is significantly impacting the membrane chromatography market. Automation technologies enhance the efficiency and reproducibility of purification processes, which is essential for large-scale production. In the UK, the integration of automated systems with membrane chromatography can lead to improved process control and reduced human error. This shift towards automation is likely to attract investments in membrane chromatography technologies, as companies aim to streamline their operations and enhance productivity. The market is expected to benefit from this trend as automation becomes a standard practice in biopharmaceutical manufacturing.

Cost-Effectiveness of Membrane Technologies

Cost considerations play a pivotal role in the membrane chromatography market. The adoption of membrane chromatography is often driven by its cost-effectiveness compared to traditional chromatography methods. The operational costs associated with membrane systems are generally lower due to reduced solvent usage and shorter processing times. This efficiency can lead to savings of up to 30% in operational expenses for biopharmaceutical manufacturers. As companies in the UK seek to optimize their production processes, the economic advantages of membrane chromatography are likely to propel its adoption, thereby influencing market dynamics.

Growing Regulatory Support for Advanced Technologies

Regulatory bodies in the UK are increasingly supportive of advanced purification technologies, including membrane chromatography. This support is evident in the establishment of guidelines that encourage the adoption of innovative methods for biopharmaceutical production. The UK Medicines and Healthcare products Regulatory Agency (MHRA) has been proactive in promoting technologies that enhance product quality and safety. As regulatory frameworks evolve to accommodate new technologies, the membrane chromatography market is likely to experience growth, as manufacturers seek to comply with these standards while improving their production processes.