Expansion of Emerging Markets

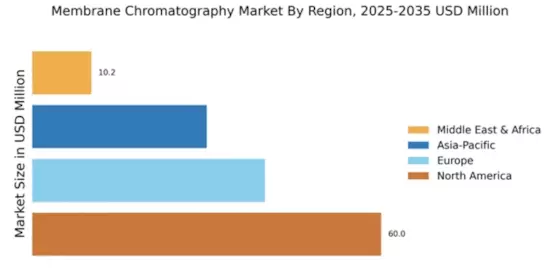

Emerging markets are playing a pivotal role in the growth of the Global Membrane Chromatography Market Industry. Countries in Asia-Pacific and Latin America are witnessing rapid industrialization and an increase in biopharmaceutical production. This expansion is driving demand for advanced purification technologies, including membrane chromatography. As these regions invest in healthcare infrastructure and biotechnology, the market is expected to flourish. The anticipated growth trajectory suggests that by 2035, the market could reach 0.77 USD Billion, reflecting the increasing adoption of membrane chromatography in these developing economies.

Rising Demand for Biopharmaceuticals

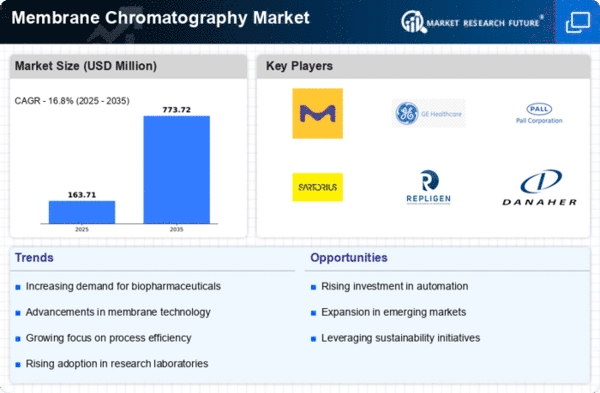

The Global Membrane Chromatography Market Industry is experiencing a surge in demand driven by the biopharmaceutical sector. As the industry continues to expand, the need for efficient purification processes becomes paramount. Membrane chromatography offers a streamlined approach to separating biomolecules, which is essential for the production of therapeutic proteins and monoclonal antibodies. In 2024, the market is valued at 0.14 USD Billion, reflecting the growing reliance on advanced purification technologies. This trend is expected to accelerate as biopharmaceutical sales are projected to reach unprecedented levels, thereby propelling the membrane chromatography market forward.

Increasing Focus on Process Optimization

The Global Membrane Chromatography Market Industry is witnessing a heightened focus on process optimization within various sectors, particularly in pharmaceuticals and biotechnology. Companies are increasingly adopting membrane chromatography due to its ability to enhance yield and reduce processing times. This optimization is crucial as organizations strive to meet regulatory requirements while maintaining product quality. The anticipated compound annual growth rate (CAGR) of 16.78% from 2025 to 2035 underscores the industry's potential for growth, driven by the need for more efficient and cost-effective purification methods.

Growing Environmental Concerns and Sustainability

Environmental sustainability is becoming a critical driver for the Global Membrane Chromatography Market Industry. As industries face increasing pressure to adopt greener practices, membrane chromatography presents a viable solution due to its lower solvent consumption and waste generation compared to traditional methods. This shift towards sustainable practices is not only beneficial for the environment but also aligns with regulatory trends favoring eco-friendly technologies. As organizations prioritize sustainability, the adoption of membrane chromatography is likely to increase, further contributing to market growth and innovation.

Technological Advancements in Membrane Technology

Innovations in membrane technology are significantly influencing the Global Membrane Chromatography Market Industry. Recent advancements have led to the development of membranes with enhanced selectivity and permeability, which improve the efficiency of separation processes. These technological enhancements not only reduce operational costs but also increase throughput, making them attractive to manufacturers. As companies invest in research and development, the market is poised for growth, with projections indicating a value of 0.77 USD Billion by 2035. This evolution in membrane technology is likely to attract new players and foster competition within the industry.