Growing Geriatric Population

The medical oxygen-concentrators market is significantly influenced by the growing geriatric population in the UK. As individuals age, they often experience a decline in respiratory function, leading to an increased need for supplemental oxygen. The Office for National Statistics indicates that the proportion of individuals aged 65 and over is projected to rise to 23% by 2035. This demographic shift is likely to result in a higher prevalence of age-related respiratory conditions, thereby driving demand for medical oxygen concentrators. Additionally, older adults are more likely to prefer home-based healthcare solutions, which further supports the market. Healthcare providers are increasingly focusing on tailored oxygen therapy solutions for this population, indicating a strong potential for growth in the medical oxygen-concentrators market.

Supportive Regulatory Framework

A supportive regulatory framework is crucial for the growth of the medical oxygen-concentrators market. In the UK, regulatory bodies are actively working to streamline the approval processes for medical devices, including oxygen concentrators. This regulatory support not only ensures the safety and efficacy of products but also encourages innovation within the industry. The Medicines and Healthcare products Regulatory Agency (MHRA) has established guidelines that facilitate the introduction of new technologies while maintaining high standards of patient care. As a result, manufacturers are more inclined to invest in the development of advanced oxygen concentrators, knowing that they can navigate the regulatory landscape effectively. This environment fosters competition and drives market growth, as companies strive to meet the evolving needs of healthcare providers and patients alike.

Rising Awareness of Home Healthcare Solutions

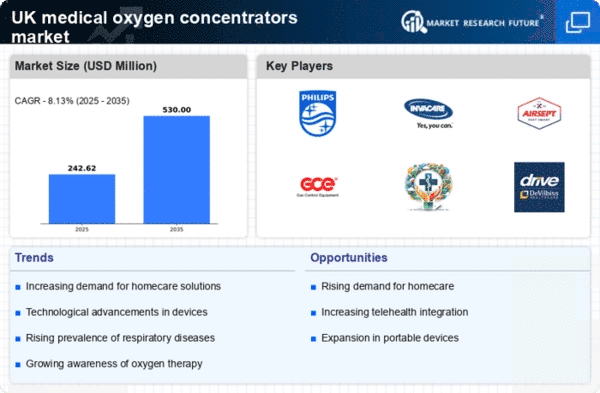

The medical oxygen-concentrators market is benefiting from an increasing awareness of home healthcare solutions among patients and caregivers in the UK. As healthcare systems evolve, there is a noticeable shift towards providing care in home settings, which is often more comfortable and cost-effective. Patients are becoming more informed about the benefits of using oxygen concentrators at home, leading to a surge in demand. According to market analysis, the home healthcare segment is expected to grow at a CAGR of over 8% in the coming years. This trend is further supported by the availability of various reimbursement policies that cover home oxygen therapy, making it more accessible to patients. Consequently, the medical oxygen-concentrators market is likely to expand as more individuals opt for home-based oxygen therapy solutions.

Increasing Prevalence of Respiratory Disorders

The medical oxygen-concentrators market is experiencing growth due to the rising incidence of respiratory disorders in the UK. Conditions such as chronic obstructive pulmonary disease (COPD) and asthma are becoming more prevalent, leading to an increased demand for oxygen therapy. According to recent health statistics, approximately 1.2 million people in the UK are diagnosed with COPD, which necessitates the use of oxygen concentrators for effective management. This trend indicates a growing patient population that requires continuous oxygen supply, thereby driving the market forward. Furthermore, the aging population, which is more susceptible to respiratory ailments, is likely to contribute to the sustained demand for medical oxygen concentrators. As healthcare providers seek to improve patient outcomes, the focus on oxygen therapy is expected to intensify, further propelling the medical oxygen-concentrators market.

Technological Innovations in Oxygen Concentrators

Technological advancements play a pivotal role in shaping the medical oxygen-concentrators market. Innovations such as portable and lightweight designs, enhanced efficiency, and user-friendly interfaces are attracting both healthcare providers and patients. The introduction of smart oxygen concentrators, which can monitor oxygen levels and provide real-time data, is particularly noteworthy. These devices not only improve patient compliance but also facilitate remote monitoring by healthcare professionals. The market is projected to grow as manufacturers invest in research and development to create more efficient and effective products. For instance, the integration of battery-operated systems allows for greater mobility, catering to the needs of patients who require oxygen therapy while maintaining an active lifestyle. Such advancements are likely to enhance the overall appeal of medical oxygen concentrators, thereby stimulating market growth.