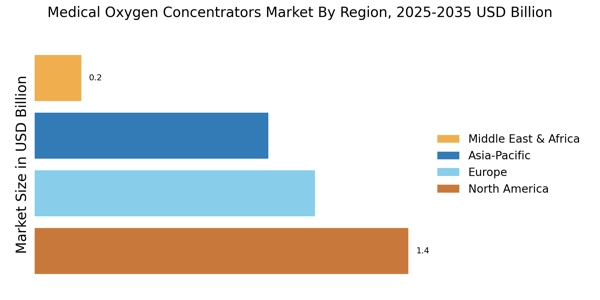

North America : Healthcare Innovation Leader

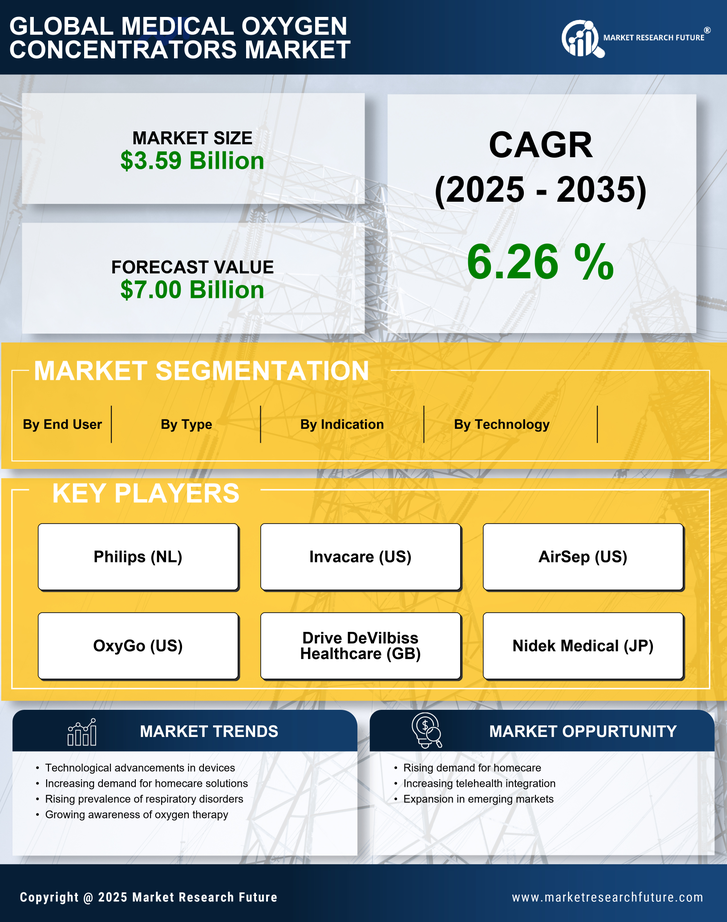

North America dominated the global medical oxygen concentrators market in 2024, reaching a market size of USD 1.4 billion. The region's growth is driven by an aging population, increasing prevalence of respiratory diseases, and advancements in technology.

Regulatory support from agencies like the FDA has also catalyzed market expansion, ensuring safety and efficacy in medical devices. The United States is the dominant player in this market, followed by Canada.

Key oxygen machine manufacturers such as Invacare, AirSep, and OxyGo are leading the competitive landscape, focusing on innovative product development and strategic partnerships, thereby encouraging consumers to purchase oxygen concentrators. The presence of established healthcare infrastructure further enhances market growth, making North America a hub for medical oxygen solutions.

Europe : Emerging Market Dynamics

Europe is witnessing significant growth in the medical oxygen concentrators market, accounting for approximately 30% of the global share. The increasing incidence of chronic respiratory diseases and supportive regulatory frameworks are key drivers. The European Medicines Agency (EMA) has implemented guidelines that facilitate the approval of innovative medical devices, enhancing market accessibility.

Leading countries in this region include Germany, France, and the UK, where portable oxygen concentrator suppliers like Philips and Drive DeVilbiss Healthcare are prominent. The competitive landscape is characterized by a mix of established players and emerging startups, focusing on technological advancements and patient-centric solutions. This dynamic environment is expected to foster further innovation and market penetration.

Asia-Pacific : Rapidly Growing Healthcare Sector

Asia-Pacific is emerging as a significant player in the medical oxygen concentrators market, holding around 25% of the global market share. The region's growth is propelled by rising healthcare expenditures, increasing awareness of respiratory health, and a growing elderly population. Government initiatives aimed at improving healthcare infrastructure are also contributing to market expansion.

Countries like Japan, China, and India are leading the charge, with a competitive landscape featuring key players such as Nidek Medical and GCE Group. The market is characterized by a mix of local and international companies, focusing on affordability and accessibility of medical oxygen solutions. This region is poised for substantial growth as healthcare systems continue to evolve and expand.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is gradually emerging in the medical oxygen concentrators market, currently holding about 5% of the global share. The growth is driven by increasing awareness of respiratory health issues and the need for improved healthcare services. Government initiatives aimed at enhancing healthcare access are also playing a crucial role in market development.

Countries like South Africa and the UAE are at the forefront, with a competitive landscape that includes both local and international players. Companies are focusing on expanding their distribution networks and improving product availability. As healthcare infrastructure improves, the demand for medical oxygen concentrators is expected to rise significantly in this region.