UK Jewelry Market

UK Jewelry Market Size, Share, Industry Trend & Analysis Research Report Information by Product Type (Magnetic Jewelry (Bracelets, Necklaces, Rings, Anklets, Earrings, Brooches, Clasps and Links), Wellness-Inspired Jewelry (Healing Crystals, Chakra Balancing Jewelry, Aromatherapy Lockets, Magnetic Therapy Jewelry)), by Material Type (Metals (Stainless Steel, Gold, Silver, Platinum, Titanium), Natural Elements (Semi-Precious Stones, Crystals (e.g., Quartz, Amethyst, Citrine), Leather), Synthetic Materials (Resin, Cubic Zirconia, Polymer Clay), Mixed Media Jewelry (Metal and Crystal Combinations, Magnetic and Leather Combinations)), by Gender (Women, Men, Unisex), by Usage (Daily Wear Jewelry, Occasional Jewelry, Therapeutic Jewelry), by Distribution Channel (Online (E-commerce Platforms, Brand Websites), Offline (Retail Stores, Specialty Boutiques, Wellness Centers) and Region(UK) - Forecast till 2035

Market Segment Insights

UK Jewelry Market Segment Insights

Jewelry by Product Types Insights

Based on product type, the UK Jewelry Market has been segmented into Magnetic Jewelry & Wellness Inspired Jewelry. The Magnetic Jewelry segment accounted for the largest market share in 2024 and is likely to register a CAGR of 5.21% during the projected period. Whereas the Wellness-Inspired Jewelry segment will likely register the highest CAGR of 5.94% during the forecast period. Magnetic jewelry has carved a unique niche in the UK market by combining fashion with potential wellness benefits. This segment has gained popularity due to the growing consumer interest in alternative therapies and holistic well-being, with many people drawn to magnetic jewelry for its believed health benefits, such as pain relief, improved circulation, and reduced inflammation.

Although scientific evidence supporting these claims is still inconclusive, the perception of therapeutic advantages has contributed to increased demand, particularly among health-conscious individuals, older demographics, and those with chronic conditions like arthritis. The magnetic jewelry segment includes a variety of products such as bracelets, rings, necklaces, and anklets, each incorporating small magnets thought to interact with the body’s natural magnetic field to promote wellness. The UK market for magnetic jewelry has expanded as more consumers seek non-invasive, drug-free solutions for pain management.

Jewelry by Material Type Insights

Based on the material type, the UK Jewelry Market has been segmented into Metals, Natural Elements, Synthetic Material, Mixed Media Jewelry. The Metal segment accounted for the largest market share of 54.68% in 2023 and is likely to register a CAGR of 4.70% during the projected period. Metal is a cornerstone material in the UK jewelry market, playing a significant role across both traditional and wellness-inspired segments, including magnetic jewelry. Its versatility, durability, and aesthetic appeal make it a popular choice for a wide range of jewelry designs, from luxury pieces to functional wellness accessories.

In the context of magnetic and wellness-inspired jewelry, metal not only enhances the visual appeal of pieces but also serves a practical purpose, particularly in therapeutic applications where the material’s properties, such as magnetism or conductivity, can have an impact on the wearer’s experience. In magnetic jewelry, metals such as stainless steel, titanium, copper, and even silver are often combined with powerful magnets to create pieces that are both functional and fashionable. Stainless steel is particularly popular due to its strength, corrosion resistance, and ability to hold magnets securely.

Jewelry by Gender Insights

Based on the gender, the UK Jewelry Market has been bifurcated into Women, Men, Unisex. The women segment accounted for the largest market share of 69.43% in 2023 and is likely to register a CAGR of 4.97% during the projected period. Whereas the Unisex segment will likely register a CAGR of 6.47% during the projected period. The women’s jewelry segment remains the dominant force in the UK jewelry market, driven by a combination of tradition, evolving fashion trends, and a strong cultural connection to personal expression through adornment. Women have long been the primary consumers of jewelry, using it not only as a fashion accessory but also as a statement of identity, status, and personal style.

In the UK, the demand for women’s jewelry spans a wide range of categories, from classic pieces like rings, necklaces, and bracelets to more modern and unique designs that incorporate alternative materials, wellness elements, and customizable options. The UK market is characterized by diverse consumer preferences, where women gravitate towards jewelry that reflects their individuality. For some, timeless luxury items, such as diamond rings, gold necklaces, and pearl earrings, continue to be highly sought after, while others are more drawn to contemporary designs that incorporate metals like titanium or stainless steel, or wellness-inspired pieces that feature healing crystals or aromatherapy elements.

Jewelry by Usage Insights

Based on the usage, the UK Jewelry Market has been bifurcated into Daily Wear Jewelry, Occasional Jewelry, Therapeutic Jewelry. The Occasional Jewelry segment accounted for the largest market share of 59.69% in 2023 and is likely to register a CAGR of 4.81% during the projected period. Whereas the Therapeutic Jewelry segment will likely register a CAGR of 8.11% during the projected period. Occasional jewelry plays a crucial role in the UK jewelry market, catering to consumers who seek special, statement-making pieces for significant events and celebrations. Unlike daily wear jewelry, occasional jewelry is designed to make an impact, adding a touch of glamour and sophistication to formal and festive occasions.

This segment includes jewelry for events such as weddings, anniversaries, parties, galas, and other milestone celebrations, where individuals look for accessories that complement their outfits and enhance their overall appearance. The demand for occasional jewelry is driven by the desire to stand out during important events, with consumers seeking pieces that offer both luxury and individuality. In the UK, the occasional jewelry market has seen a shift towards more personalized and custom-made designs, reflecting the growing trend of individuality and self-expression. Consumers are increasingly opting for unique, one-of-a-kind pieces that reflect their personal style and the significance of the occasion.

Jewelry by Distribution Channel Insights

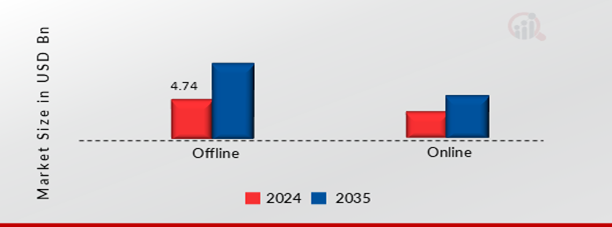

Based on the distribution channel, the UK Jewelry Market has been bifurcated into Online & Offline. The offline segment accounted for the largest market share of 73.49% in 2023 and is likely to register a CAGR of 4.71% during the projected period. The offline channel remains a crucial element of the jewelry market in the UK, offering customers a tactile and personal shopping experience that e-commerce platforms cannot replicate. Traditional brick-and-mortar stores, department stores, and jewelry boutiques continue to hold strong appeal for consumers seeking a more interactive and sensory retail experience.

One of the main advantages of the offline channel is the ability for customers to physically see, touch, and try on jewelry before making a purchase. This is particularly important for high-value items such as engagement rings, wedding bands, and luxury watches, where consumers want to feel confident in their investment. Jewelry stores in prominent locations, such as high streets, shopping malls, or luxury shopping districts, allow brands to create immersive and polished shopping environments that highlight their unique designs and craftsmanship. The in-store experience provides an opportunity for personal interaction with knowledgeable sales associates who can offer expert advice, answer questions, and assist with customization requests.

FIGURE 2: UK JEWELRY MARKET SHARE BY DISTRIBUTION CHANNEL 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Key Players and Competitive Insights

Many UK, regional, and local vendors characterize the Jewelry Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major competitors in the market are SIGNET JEWELLERS LTD, Garrard & Co. Ltd, Pandora A/S, Anglo American Plc, Bridgepoint Group, Richemont Group, HEIMERLE + MEULE GMBH, LVMH Moet Hennessy Louis Vuitton, Chopard, Graff Diamonds Ltd among others. The UK Jewelry Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Industry Developments

May 2024: Signet Jewelers and De Beers Group have announced a strategic collaboration aimed at introducing natural diamonds to a new generation of U.S. and Canadian couples. The Signet Jewelers and De Beers collaboration may influence the UK jewelry market by reinforcing consumer preference for natural diamonds, driving demand for ethically sourced and premium quality gemstones.

May 2024: Announcement regarding its agreement to acquire 100% of the Italian jewelry Maison Vhernier S.p.A., Richemont has now completed the transaction after meeting customary conditions and obtaining the necessary regulatory approvals. The acquisition of Vhernier S.p.A. by Richemont strengthens its luxury jewelry portfolio, increasing competition in the UK high-end jewelry market and influencing consumer preferences for exclusive Italian designs.

March 2023: Bridgepoint Development Capital IV acquired a majority stake in Monica Vinader, strengthening its position in the premium jewelry market. This acquisition increased competition in the UK jewelry sector, particularly in the affordable luxury segment.

June 2018: De Beers Group has announced the launch of a new company – Lightbox Jewelry that will begin marketing a new brand of laboratory-grown diamond jewelry under the Lightbox name in September, offering consumers high-quality, fashion jewelry designs at lower prices than existing lab-grown diamond offerings. Lightbox lab-grown diamonds will retail from US$200 for a quarter-carat stone to US$800 for a one-carat stone. The line will bring something new and innovative to the jewelry sector, featuring pink, blue and white lab-grown diamonds in a selection of accessibly priced earring and necklace designs.

UK Jewelry Market Segmentation

Jewelry by Product type Outlook

-

Magnetic Jewelry

- Bracelets

- Necklaces

- Rings

- Anklets

- Earrings

- Brooches

- Clasps and Links

-

Wellness-Inspired Jewelry

- Healing Crystals

- Chakra Balancing Jewelry

- Aromatherapy Lockets

- Magnetic Therapy Jewelry

Jewelry by Material Type Outlook

-

Metals

- Stainless Steel

- Gold

- Silver

- Platinum

- Titanium

-

Natural Elements

- Semi-Precious Stones

- Crystals (e.g., Quartz, Amethyst, Citrine)

- Leather

-

Synthetic Materials

- Resin

- Cubic Zirconia

- Polymer Clay

-

Mixed Media Jewelry

- Metal and Crystal Combinations

- Magnetic and Leather Combinations

Jewelry by Gender Outlook

- Women

- Men

- Unisex

Jewelry by Usage Outlook

- Daily Wear Jewelry

- Occasional Jewelry

- Therapeutic Jewelry

Jewelry Distribution Channel Outlook

-

Online

- E-commerce Platforms

- Brand Websites

-

Offline

- Retail Stores

- Specialty Boutiques

- Wellness Centers

Market Segmentation

Jewelry by Usage Outlook

- Daily Wear Jewelry

- Occasional Jewelry

- Therapeutic Jewelry

Jewelry by Gender Outlook

- Women

- Men

- Unisex

Jewelry by Product type Outlook

- Magnetic Jewelry Bracelets Necklaces Rings Anklets Earrings Brooches Clasps and Links

- Wellness-Inspired Jewelry Healing Crystals Chakra Balancing Jewelry Aromatherapy Lockets Magnetic Therapy Jewelry

Jewelry by Material Type Outlook

- Metals Stainless Steel Gold Silver Platinum Titanium

- Natural Elements Semi-Precious Stones Crystals (e.g., Quartz, Amethyst, Citrine) Leather

- Synthetic Materials Resin Cubic Zirconia Polymer Clay

- Mixed Media Jewelry Metal and Crystal Combinations Magnetic and Leather Combinations

Jewelry Distribution Channel Outlook

- Online E-commerce Platforms Brand Websites

- Offline Retail Stores Specialty Boutiques Wellness Centers

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 6.48 Billion |

| Market Size 2025 | USD 6.78 Billion |

| Market Size 2035 | USD 9.90 Billion |

| Compound Annual Growth Rate (CAGR) | 5.23% (2025-2035) |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Historical Data | 2019-2023 |

| Forecast Units | Value, Volume (USD Billion, Million Units) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product type, Material Type, Gender, Usage, Distribution Channel |

| Geographies Covered | UK |

| Countries Covered | UK |

| Key Companies Profiled | SIGNET JEWELLERS LTD, Garrard & Co. Ltd, Pandora A/S, Anglo American Plc, Bridgepoint Group, Richemont Group, HEIMERLE + MEULE GMBH, LVMH Moet Hennessy Louis Vuitton, Chopard, Graff Diamonds Ltd |

| Key Market Opportunities | · Lightweight and innovative designs · Collaboration with fashion brands |

| Key Market Dynamics | · Increasing disposable income · Changing consumer preferences towards sustainable and ethically sourced materials |

FAQs

How much is the UK Jewelry Market?

The UK Jewelry Market was valued at USD 6.48 Billion in 2024.

Which Usage holds the largest market share?

The Occasional Jewelry segment by Usage holds the largest market share and grows at a CAGR of 4.81% during the forecast period.

Who are the prominent players in the UK Jewelry Market?

SIGNET JEWELLERS LTD, Garrard & Co. Ltd, Pandora A/S, Anglo American Plc, Bridgepoint Group, Richemont Group, HEIMERLE + MEULE GMBH, LVMH Moet Hennessy Louis Vuitton, Chopard, Graff Diamonds Ltd are prominent players in the UK Jewelry Market.

Which Distribution Channel segment led the UK Jewelry Market?

The Offline Systems segment dominated the market in 2024.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”