Shift Towards Cloud-Based Solutions

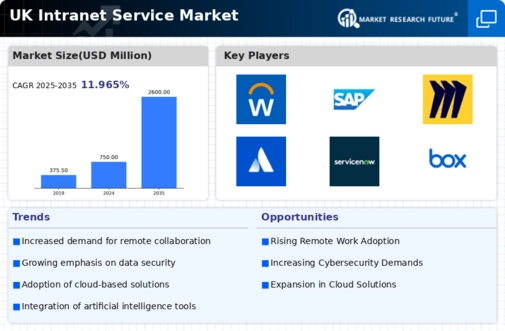

The shift towards cloud-based solutions is a prominent trend in the UK intranet service market. Organizations are increasingly adopting cloud technology to enhance scalability, flexibility, and cost-effectiveness. Recent data indicates that over 50% of UK businesses have migrated their intranet services to the cloud, allowing for easier updates and maintenance. This transition is likely to continue as companies seek to reduce IT overhead and improve accessibility for remote teams. Cloud-based intranet solutions also offer enhanced collaboration features, enabling employees to access information from anywhere. As a result, the UK intranet service market is witnessing a transformation, with providers focusing on delivering cloud-based offerings that meet the diverse needs of modern organizations.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into intranet services is emerging as a pivotal driver in the UK intranet service market. AI technologies are being utilized to enhance user experience, streamline workflows, and provide personalized content recommendations. For instance, AI-driven chatbots are increasingly being deployed to assist employees with common queries, thereby reducing the burden on IT support teams. Recent market analysis suggests that AI adoption in intranet services could increase productivity by up to 30% in the UK. This trend indicates a shift towards more intelligent intranet solutions that not only improve efficiency but also adapt to the unique needs of organizations, positioning the UK intranet service market for substantial growth.

Emphasis on Data Security and Compliance

In the UK intranet service market, there is an increasing emphasis on data security and compliance with regulations such as the General Data Protection Regulation (GDPR). Organizations are becoming more aware of the potential risks associated with data breaches and are prioritizing the implementation of secure intranet solutions. Recent statistics indicate that over 70% of UK companies consider data protection a top priority when selecting intranet services. This heightened focus on security is prompting service providers to enhance their security features, including encryption, access controls, and regular audits. As a result, the UK intranet service market is evolving to offer solutions that not only meet compliance requirements but also instill confidence among users regarding the safety of their sensitive information.

Rising Importance of Employee Engagement

Employee engagement is becoming a critical focus for organizations within the UK intranet service market. Companies are recognizing that a well-designed intranet can significantly enhance employee satisfaction and retention. Research indicates that organizations with high employee engagement levels experience 21% higher profitability. As a result, businesses are investing in intranet solutions that foster a sense of community, provide access to resources, and encourage feedback. This trend is likely to drive the development of features such as social networking capabilities, employee recognition programs, and interactive content. Consequently, the UK intranet service market is evolving to prioritize tools that not only facilitate communication but also actively engage employees in their work environment.

Growing Demand for Remote Collaboration Tools

The UK intranet service market is witnessing a growing demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication and collaboration platforms has surged. According to recent data, approximately 60% of UK businesses have implemented remote work policies, necessitating robust intranet solutions that facilitate seamless interaction among employees. This trend is likely to drive the development of advanced intranet services that integrate video conferencing, document sharing, and real-time messaging functionalities. Consequently, providers in the UK intranet service market are focusing on enhancing their offerings to meet these evolving needs, ensuring that businesses can maintain productivity and engagement regardless of their employees' physical locations.