Shift Towards Cloud-Based Solutions

The shift towards cloud-based solutions is a significant driver in the Japan intranet service market. As organizations seek to reduce operational costs and enhance scalability, cloud-based intranet services are gaining traction. This transition allows companies to access their intranet systems from anywhere, facilitating remote work and collaboration. Data suggests that the cloud services market in Japan is projected to grow at a CAGR of 15% over the next five years, reflecting a broader trend towards digital transformation. This shift not only provides flexibility but also enables organizations to leverage advanced technologies, such as big data analytics and machine learning, to optimize their intranet services.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) within the Japan intranet service market is emerging as a transformative driver. AI technologies are being utilized to enhance user experience, streamline workflows, and improve decision-making processes. For instance, AI-powered chatbots are increasingly deployed to assist employees in navigating intranet systems, thereby reducing response times and increasing efficiency. Furthermore, the market for AI in enterprise applications is expected to reach USD 1.5 billion by 2026 in Japan, indicating a robust growth trajectory. This trend suggests that organizations are recognizing the potential of AI to revolutionize their intranet services, making them more intuitive and responsive to user needs.

Growing Demand for Remote Work Solutions

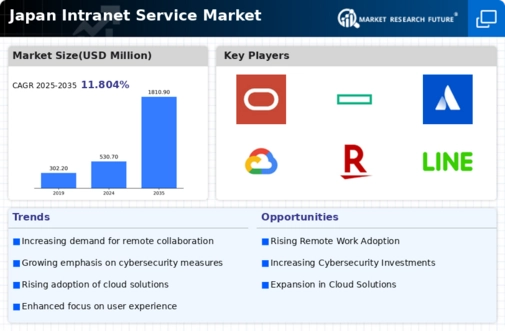

The Japan intranet service market is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for robust intranet services that facilitate communication and collaboration among remote teams has become paramount. According to recent data, approximately 60% of Japanese companies have implemented remote work policies, driving the necessity for effective intranet platforms. These platforms not only enhance productivity but also ensure that employees remain connected, regardless of their physical location. This trend indicates a shift in workplace dynamics, compelling intranet service providers to innovate and adapt their offerings to meet the evolving needs of businesses in Japan.

Regulatory Compliance and Data Protection

In the Japan intranet service market, regulatory compliance and data protection are increasingly critical drivers. The Japanese government has enacted stringent data protection laws, such as the Act on the Protection of Personal Information (APPI), which mandates organizations to safeguard personal data. As a result, companies are prioritizing intranet solutions that ensure compliance with these regulations. The market for data protection services is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of 10% over the next five years. This focus on compliance not only protects organizations from potential legal repercussions but also enhances their reputation among clients and stakeholders.

Focus on Employee Engagement and Collaboration

Employee engagement and collaboration are pivotal drivers in the Japan intranet service market. Organizations are increasingly recognizing the importance of fostering a collaborative work environment to enhance productivity and job satisfaction. Intranet platforms that facilitate knowledge sharing, project management, and social interaction are becoming essential tools for businesses. Recent surveys indicate that companies with high employee engagement levels experience a 20% increase in productivity. Consequently, intranet service providers are focusing on developing features that promote collaboration, such as integrated communication tools and social networking capabilities, to meet the demands of modern workplaces in Japan.