Regulatory Changes

The regulatory landscape is a crucial driver for the insuretech market, particularly in the UK. Recent reforms aimed at enhancing consumer protection and promoting competition have prompted insurers to innovate. The Financial Conduct Authority (FCA) has introduced measures that encourage transparency and fairness in pricing, which has led to a surge in insuretech startups. These companies are leveraging technology to comply with regulations while offering competitive products. As of November 2025, it is anticipated that the insuretech market will continue to evolve in response to regulatory changes, fostering an environment where innovation thrives alongside compliance.

Increased Investment

Investment in the insuretech market is witnessing a notable surge, driven by both venture capital and corporate funding. In 2025, the UK insuretech sector is projected to attract over £1 billion in investments, reflecting the growing confidence in technology-driven insurance solutions. This influx of capital is enabling startups to develop innovative products and services that challenge traditional insurance models. Moreover, established insurers are increasingly collaborating with insuretech firms to enhance their offerings and improve operational efficiencies. This trend of increased investment is likely to accelerate the pace of innovation within the market, creating a dynamic ecosystem that benefits consumers and businesses alike.

Technological Advancements

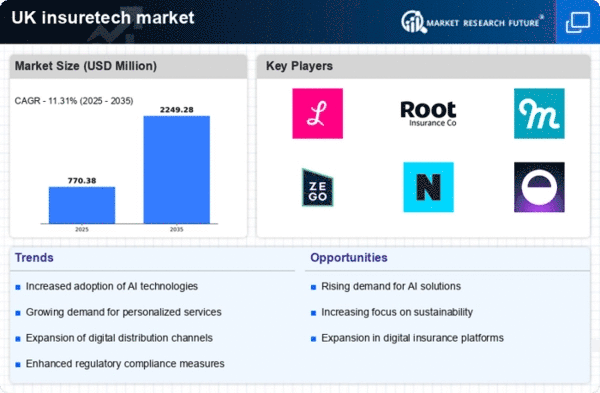

The rapid evolution of technology is a primary driver in the insuretech market. Innovations such as artificial intelligence (AI), machine learning, and blockchain are transforming traditional insurance processes. For instance, AI is being utilized for risk assessment and fraud detection, enhancing operational efficiency. In 2025, it is estimated that the UK insuretech market will witness a growth rate of approximately 25%, largely attributed to these technological advancements. Furthermore, the integration of big data analytics allows insurers to offer personalized products, catering to individual customer needs. This shift towards technology-driven solutions is reshaping the competitive landscape, compelling traditional insurers to adapt or risk obsolescence.

Data-Driven Decision Making

The emphasis on data-driven decision making is reshaping the insuretech market. Insurers are increasingly harnessing data analytics to inform their strategies, from underwriting to claims processing. By leveraging vast amounts of data, companies can identify trends, assess risks more accurately, and tailor products to meet specific customer needs. In 2025, it is estimated that data analytics will play a pivotal role in driving operational efficiencies, with companies reporting up to 30% reductions in costs associated with claims management. This focus on data not only enhances profitability but also improves customer satisfaction, as insurers can offer more relevant and timely solutions.

Changing Consumer Expectations

Consumer expectations are evolving, significantly impacting the insuretech market. Today's customers demand seamless digital experiences, transparency, and personalized services. A recent survey indicated that over 70% of UK consumers prefer to manage their insurance policies online, highlighting the necessity for digital platforms. Insurers are increasingly focusing on user-friendly interfaces and mobile applications to meet these demands. This shift is not merely a trend but a fundamental change in how insurance products are marketed and delivered. As a result, companies that fail to adapt to these changing expectations may find themselves losing market share to more agile insuretech firms that prioritize customer-centric solutions.