Rising Awareness of Insurance Products

There is a notable increase in awareness regarding insurance products among consumers in the GCC, which is positively influencing the insuretech market. As individuals become more informed about the benefits of insurance, the demand for various products is expected to rise. Educational campaigns and digital marketing strategies are playing a crucial role in enhancing consumer knowledge. This heightened awareness is likely to lead to increased policy uptake, particularly among younger demographics who are more inclined to explore digital insurance solutions. Consequently, the insuretech market is anticipated to benefit from this trend, as insurers adapt their offerings to meet the needs of a more informed customer base.

Increased Investment in Insurtech Startups

Investment in insuretech startups is on the rise, serving as a significant driver for the insuretech market. In the GCC, venture capital firms and private equity investors are increasingly recognizing the potential of innovative insurance solutions. In 2025 alone, investments in the region's insuretech startups have surpassed $300 million, reflecting a growing confidence in the market's future. This influx of capital enables startups to develop cutting-edge technologies and expand their offerings, fostering a more competitive environment. As these startups introduce disruptive solutions, established insurers are compelled to innovate, thereby accelerating the overall growth of the insuretech market.

Regulatory Evolution Supporting Innovation

The regulatory landscape in the GCC is evolving to support innovation within the insuretech market. Governments are increasingly recognizing the importance of fostering a conducive environment for technological advancements in insurance. Initiatives aimed at simplifying compliance processes and encouraging experimentation with new business models are gaining traction. For instance, regulatory sandboxes have been established to allow startups to test their solutions in a controlled environment. This supportive regulatory framework is likely to attract more players to the insuretech market, enhancing competition and driving innovation. As a result, the GCC is poised to become a hub for insuretech innovation, further propelling market growth.

Technological Advancements in Data Analytics

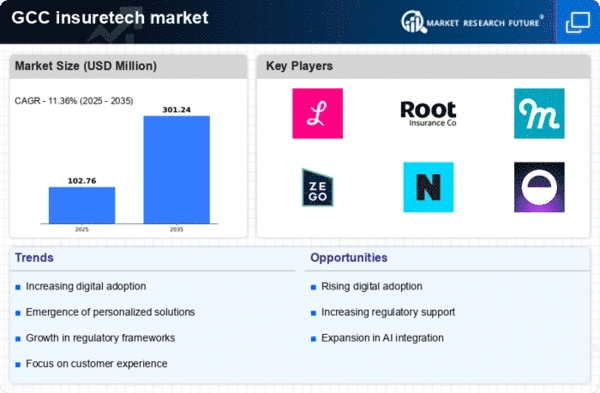

The insuretech market is experiencing a surge in technological advancements, particularly in data analytics. Enhanced data processing capabilities allow insurers to analyze vast amounts of information, leading to improved risk assessment and pricing strategies. In the GCC, the adoption of artificial intelligence (AI) and machine learning (ML) is becoming increasingly prevalent, enabling companies to offer tailored products and services. This trend is reflected in the projected growth of the GCC insuretech market, which is expected to reach approximately $1.5 billion by 2026. The ability to leverage data effectively not only enhances customer experience but also optimizes operational efficiency, making it a critical driver in the insuretech market.

Growing Consumer Demand for Digital Solutions

Consumer preferences are shifting towards digital solutions, significantly impacting the insuretech market. In the GCC, a growing number of customers are seeking seamless online experiences for purchasing insurance products. This demand is driven by the increasing penetration of smartphones and internet connectivity, which facilitates easy access to insurance services. As a result, companies are investing in user-friendly platforms and mobile applications to cater to this trend. The GCC insuretech market is projected to grow at a CAGR of 15% over the next five years, indicating that businesses must adapt to meet evolving consumer expectations. This shift towards digitalization is likely to reshape the competitive landscape of the insuretech market.