Supportive Government Policies

Supportive government policies and initiatives are playing a crucial role in the expansion of the home infusion-therapy-devices market. The UK government has been actively promoting home healthcare solutions to enhance patient care and reduce healthcare costs. Initiatives aimed at integrating home infusion therapies into standard care practices are gaining traction, with funding allocated to support these programs. This governmental backing not only facilitates access to home infusion therapies but also encourages innovation within the market. As policies continue to evolve in favor of home-based care, the home infusion-therapy-devices market is likely to experience substantial growth.

Cost-Effectiveness of Home Care

The economic advantages associated with home care are significantly influencing the home infusion-therapy-devices market. Home infusion therapy is often more cost-effective than hospital stays, reducing overall healthcare expenditures. A study indicates that home-based treatments can save the NHS up to £1,000 per patient compared to traditional inpatient care. This financial incentive encourages healthcare systems to promote home infusion therapies, as they not only enhance patient comfort but also alleviate the burden on hospital resources. As a result, the demand for home infusion-therapy-devices is expected to rise, driven by the need for more economical healthcare solutions.

Increased Awareness and Education

Growing awareness and education regarding home infusion therapies are pivotal in driving the home infusion-therapy-devices market. Healthcare professionals and patients are becoming more informed about the benefits of home-based treatments, leading to a shift in perception. Educational initiatives by healthcare organizations are promoting the advantages of home infusion, such as improved quality of life and reduced hospital visits. This increased awareness is likely to result in a higher acceptance rate of home infusion therapies among patients, thereby expanding the market. As more individuals seek alternatives to traditional hospital care, the demand for home infusion-therapy-devices is expected to grow.

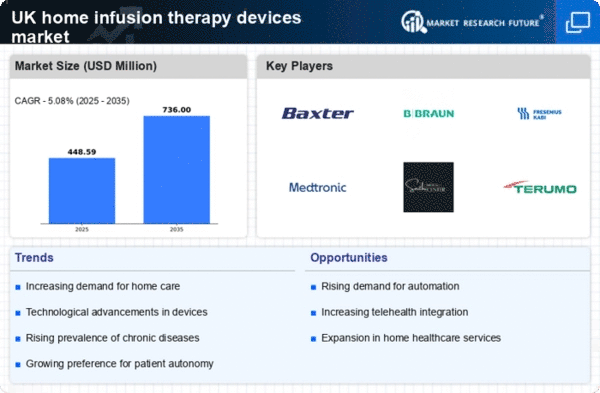

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in the UK is a primary driver for the home infusion-therapy-devices market. Conditions such as diabetes, cancer, and heart disease necessitate ongoing treatment, often requiring infusion therapies. According to recent data, approximately 15 million people in the UK live with chronic conditions, leading to a heightened demand for home-based care solutions. This trend is likely to continue, as the population ages and the prevalence of these diseases rises. Consequently, healthcare providers are increasingly adopting home infusion therapies to manage patient care effectively, thereby propelling the growth of the home infusion-therapy-devices market.

Technological Innovations in Infusion Devices

Technological advancements in infusion devices are transforming the home infusion-therapy-devices market. Innovations such as smart pumps, mobile applications, and remote monitoring systems enhance the safety and efficacy of home infusion therapies. These devices allow for precise medication delivery and real-time monitoring, which can significantly improve patient outcomes. The integration of technology into home care settings is becoming increasingly prevalent, with a projected growth rate of 10% in the adoption of smart infusion devices over the next five years. This trend indicates a robust future for the home infusion-therapy-devices market, as technology continues to evolve and improve patient care.