Increased Regulatory Scrutiny

Increased regulatory scrutiny is a prominent driver impacting the healthcare payer-services market. Regulatory bodies in the UK are intensifying their oversight of payer practices, particularly concerning transparency and accountability. This heightened scrutiny necessitates that payers enhance their compliance frameworks and reporting mechanisms. As regulations evolve, payers must adapt their operations to meet new standards, which may involve significant investments in technology and training. The healthcare payer-services market is thus likely to see a surge in demand for compliance-related services, as payers seek to navigate the complexities of regulatory requirements while maintaining operational efficiency.

Shift Towards Preventive Care

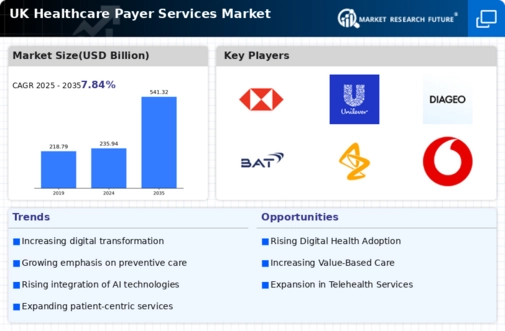

The healthcare payer-services market is experiencing a shift towards preventive care models. This transition is largely influenced by the recognition that proactive health management can lead to better patient outcomes and reduced long-term costs. In the UK, initiatives aimed at promoting preventive care, such as health screenings and wellness programs, are gaining traction. Payers are increasingly incentivising preventive measures, which not only improve population health but also mitigate the financial burden on the healthcare system. As a result, the healthcare payer-services market is likely to expand as payers develop innovative products and services that support preventive care initiatives.

Growing Focus on Patient-Centric Care

The healthcare payer-services market is increasingly focused on patient-centric care models. This focus is driven by the recognition that patient engagement and satisfaction are critical to achieving positive health outcomes. In the UK, payers are adopting strategies that prioritise the needs and preferences of patients, such as personalised care plans and enhanced communication channels. This shift not only fosters stronger relationships between payers and patients but also encourages adherence to treatment protocols. As the demand for patient-centric services continues to rise, the healthcare payer-services market is expected to evolve, with payers innovating their offerings to align with this growing emphasis on patient engagement.

Rising Demand for Integrated Services

The healthcare payer-services market is experiencing a notable shift towards integrated service models. This trend is driven by the increasing demand for seamless coordination between various healthcare providers and payers. As patients seek more comprehensive care solutions, payers are compelled to adapt their services accordingly. The integration of services not only enhances patient satisfaction but also improves operational efficiency. In the UK, the National Health Service (NHS) has been advocating for integrated care systems, which aim to streamline patient journeys and reduce fragmentation in service delivery. This push for integration is likely to bolster the healthcare payer-services market, as payers align their offerings with the evolving needs of patients and providers alike.

Technological Advancements in Data Analytics

Technological advancements in data analytics are significantly influencing the healthcare payer-services market. The ability to harness big data allows payers to gain insights into patient behaviours, treatment outcomes, and cost efficiencies. In the UK, the implementation of advanced analytics tools is becoming increasingly prevalent, enabling payers to make informed decisions regarding risk management and resource allocation. According to recent estimates, the use of predictive analytics in healthcare could lead to a reduction in unnecessary hospital admissions by up to 20%. This capability not only enhances the quality of care but also optimises operational costs, thereby driving growth in the healthcare payer-services market.