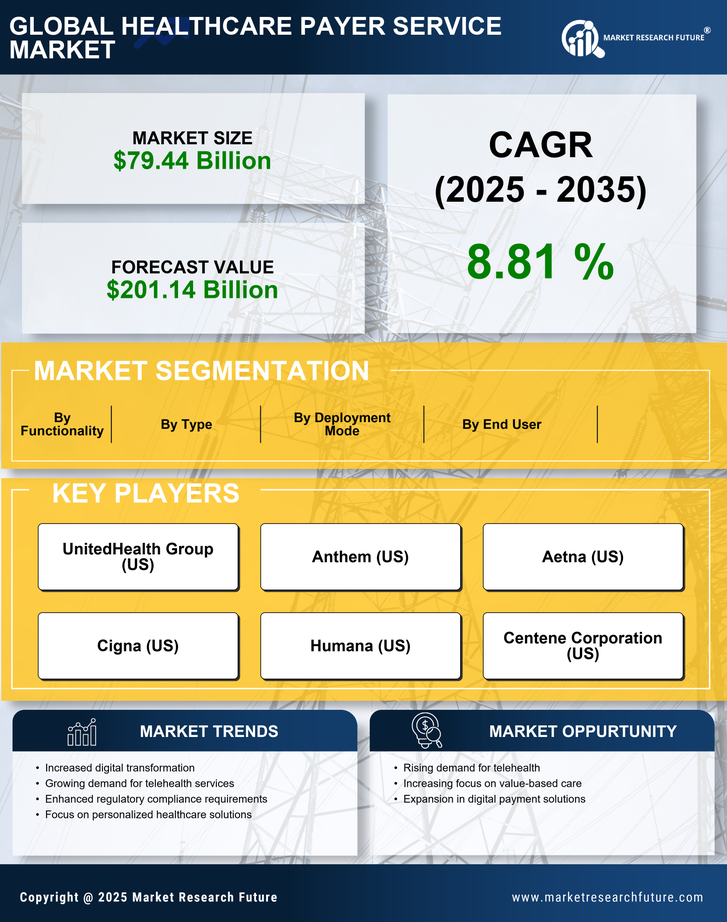

Rising Demand for Telehealth Services

The increasing demand for telehealth services is a pivotal driver in the Healthcare Payer Service Market. As patients seek more accessible healthcare options, telehealth has emerged as a viable solution. According to recent data, telehealth utilization has surged, with estimates indicating that over 30% of patients now prefer virtual consultations. This shift necessitates that healthcare payers adapt their service offerings to accommodate telehealth reimbursement models. Consequently, payers are investing in technology and infrastructure to support these services, which may lead to enhanced patient satisfaction and improved health outcomes. The integration of telehealth into payer services not only streamlines operations but also aligns with the broader trend of digital transformation in healthcare, thereby reshaping the payer landscape.

Shift Towards Value-Based Care Models

The transition towards value-based care models is reshaping the Healthcare Payer Service Market. This paradigm shift emphasizes patient outcomes over service volume, compelling payers to rethink their reimbursement strategies. Data suggests that value-based care initiatives can lead to a reduction in healthcare costs by up to 20% while improving patient satisfaction. As a result, payers are increasingly investing in care coordination and management programs that align with these models. This shift not only enhances the quality of care but also fosters a more sustainable healthcare system. Payers that successfully implement value-based care strategies are likely to experience improved financial performance and patient loyalty.

Technological Advancements in Healthcare

Technological advancements are a driving force in the Healthcare Payer Service Market. Innovations such as artificial intelligence, machine learning, and blockchain are transforming how payers operate. For instance, AI-driven analytics can enhance claims processing efficiency, potentially reducing administrative costs by up to 30%. Furthermore, blockchain technology offers secure and transparent data sharing, which is crucial for maintaining patient privacy and trust. As these technologies continue to evolve, payers are likely to adopt them to streamline operations and improve service delivery. The integration of advanced technologies not only enhances operational efficiency but also positions payers to better meet the demands of an increasingly tech-savvy patient population.

Growing Focus on Consumer-Centric Services

The growing focus on consumer-centric services is reshaping the Healthcare Payer Service Market. As patients become more informed and engaged in their healthcare decisions, payers are compelled to enhance their service offerings. This trend is reflected in the increasing demand for personalized healthcare solutions, which can improve patient satisfaction and retention. Data indicates that payers that prioritize consumer engagement strategies may see a 15% increase in member retention rates. Additionally, the rise of health apps and online portals allows patients to access information and manage their healthcare more effectively. By adopting a consumer-centric approach, payers can foster stronger relationships with their members, ultimately leading to improved health outcomes and financial performance.

Regulatory Changes and Compliance Requirements

Regulatory changes and compliance requirements significantly influence the Healthcare Payer Service Market. As governments worldwide implement new healthcare policies, payers must navigate complex regulatory landscapes. For instance, recent legislation has mandated increased transparency in pricing and coverage, compelling payers to enhance their reporting and compliance mechanisms. This shift may lead to increased operational costs but also presents opportunities for innovation in service delivery. Payers that proactively adapt to these changes are likely to gain a competitive edge. Moreover, compliance with evolving regulations can enhance trust and credibility among consumers, which is essential in a market where patient choice is increasingly paramount.