Focus on Supply Chain Resilience

The generative ai-in-fulfillment-logistics market is witnessing a heightened focus on supply chain resilience. Recent disruptions have underscored the importance of robust logistics systems capable of adapting to unforeseen challenges. Generative AI technologies are being leveraged to enhance predictive capabilities and improve decision-making processes. By utilizing AI-driven insights, companies can better anticipate disruptions and respond proactively. This emphasis on resilience is likely to drive further investment in generative AI solutions, as businesses aim to fortify their supply chains against future uncertainties.

Regulatory Support for Innovation

Regulatory frameworks in the UK are increasingly supportive of innovation within the generative ai-in-fulfillment-logistics market. Government initiatives aimed at fostering technological advancements are encouraging businesses to explore AI applications in logistics. This supportive environment is likely to stimulate investment in generative AI technologies, as companies seek to comply with evolving regulations while enhancing operational efficiency. The potential for government grants and incentives further incentivizes firms to adopt AI-driven solutions, thereby driving growth in the market.

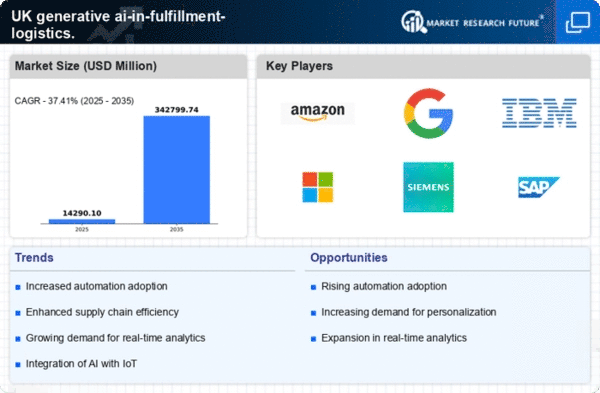

Rising Demand for Personalization

The generative ai-in-fulfillment-logistics market is experiencing a notable increase in demand for personalized services. Consumers in the UK are increasingly seeking tailored experiences, which necessitates advanced logistics solutions. This trend is prompting companies to adopt generative AI technologies that can analyze customer data and preferences, thereby enhancing service delivery. According to recent estimates, the market for personalized logistics solutions is projected to grow by approximately 25% annually. This shift towards personalization is driving investments in AI-driven fulfillment systems, as businesses strive to meet evolving consumer expectations and improve customer satisfaction.

Cost Efficiency through AI Integration

Cost efficiency remains a critical driver in the generative ai-in-fulfillment-logistics market. Companies are under constant pressure to reduce operational costs while maintaining service quality. The integration of generative AI technologies is enabling firms to optimize their supply chain processes, leading to significant cost savings. For instance, AI can streamline inventory management and reduce waste, potentially lowering logistics costs by up to 15%. As businesses in the UK seek to enhance their competitive edge, the adoption of AI-driven solutions is becoming increasingly prevalent, thereby propelling market growth.

Advancements in Technology Infrastructure

The generative ai-in-fulfillment-logistics market is benefiting from rapid advancements in technology infrastructure. The proliferation of high-speed internet and cloud computing capabilities in the UK is facilitating the deployment of sophisticated AI applications. These technologies enable real-time data processing and analytics, which are essential for effective logistics management. As companies invest in modernizing their IT infrastructure, the demand for generative AI solutions is expected to rise. This trend indicates a shift towards more agile and responsive logistics operations, ultimately enhancing overall efficiency in the market.