Sustainability Initiatives

Sustainability initiatives are becoming increasingly important in the generative ai-in-fulfillment-logistics market. French companies are under pressure to reduce their carbon footprint and adopt eco-friendly practices. The integration of generative AI can facilitate more efficient route planning and resource allocation, potentially leading to a reduction in emissions. Reports suggest that logistics firms that implement AI-driven sustainability measures could see a 30% decrease in operational waste by 2028. As businesses strive to align with environmental regulations and consumer preferences for sustainable practices, the demand for AI solutions in logistics is expected to grow.

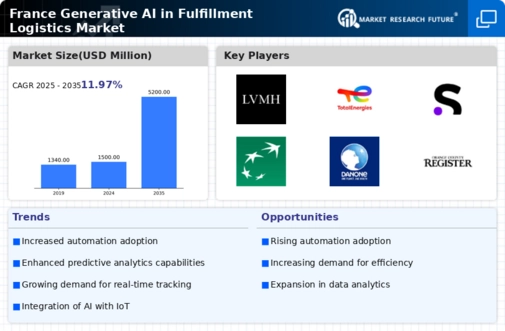

Rising Demand for Efficiency

The generative ai-in-fulfillment-logistics market is experiencing a notable surge in demand for efficiency across supply chains. Companies are increasingly seeking solutions that can streamline operations, reduce lead times, and optimize inventory management. In France, logistics firms are projected to invest approximately €1.5 billion in AI technologies by 2026, indicating a strong commitment to enhancing operational efficiency. This trend is driven by the need to meet customer expectations for faster delivery and improved service levels. As businesses adopt generative AI, they are likely to witness significant improvements in their fulfillment processes, which could lead to a competitive advantage in the market.

Evolving Consumer Expectations

Evolving consumer expectations are significantly influencing the generative ai-in-fulfillment-logistics market. Today's consumers demand personalized experiences, rapid delivery, and transparency in the supply chain. In France, a survey indicated that 75% of consumers prioritize fast shipping options, prompting logistics providers to adapt their strategies accordingly. The generative AI solutions enable companies to analyze consumer behavior and preferences, allowing for tailored fulfillment strategies. This shift towards meeting consumer demands is likely to drive innovation and investment in AI-driven logistics solutions, ultimately enhancing customer satisfaction and loyalty.

Government Support and Regulations

Government support and regulations play a crucial role in shaping the generative ai-in-fulfillment-logistics market. In France, the government has initiated various programs aimed at promoting the adoption of AI technologies in logistics. These initiatives include funding opportunities and regulatory frameworks that encourage innovation. The French government has allocated €500 million to support AI research and development in logistics by 2025. This backing is likely to accelerate the integration of generative AI solutions, enabling companies to enhance their fulfillment processes while complying with evolving regulations.

Integration of Advanced Technologies

The integration of advanced technologies is a pivotal driver in the generative ai-in-fulfillment-logistics market. Companies in France are increasingly adopting AI, machine learning, and data analytics to enhance their logistics operations. This integration allows for real-time tracking, predictive maintenance, and improved decision-making processes. According to recent estimates, the adoption of AI in logistics could lead to a reduction in operational costs by up to 20% by 2027. As firms leverage these technologies, they are likely to enhance their fulfillment capabilities, thereby positioning themselves favorably in the competitive landscape.