Expansion of IoT Applications

The expansion of Internet of Things (IoT) applications is significantly impacting the field programmable-gate-array market. As more devices become interconnected, the demand for flexible and efficient processing solutions is rising. FPGAs are well-suited for IoT applications due to their ability to handle diverse tasks and adapt to changing requirements. In the UK, the IoT market is projected to grow by 20% annually, which will likely drive further adoption of FPGAs. This trend indicates a robust future for the field programmable-gate-array market as it aligns with the increasing need for smart, connected devices.

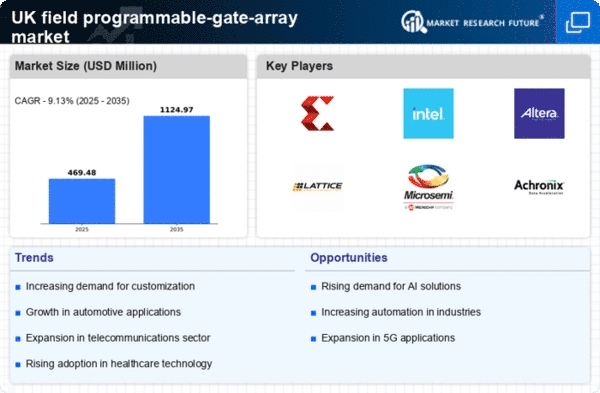

Rising Demand for Customization

The field programmable-gate-array market is experiencing a notable increase in demand for customization across various sectors. Industries such as telecommunications and automotive are seeking tailored solutions that can be rapidly deployed and modified. This trend is driven by the need for specific functionalities that standard components cannot provide. In the UK, the market for customized FPGAs is projected to grow at a CAGR of approximately 10% over the next five years. This customization allows companies to enhance their product offerings, thereby increasing competitiveness. As businesses strive to differentiate themselves, the field programmable-gate-array market is likely to benefit from this shift towards bespoke solutions.

Technological Advancements in FPGA Design

Technological advancements in FPGA design are significantly influencing the field programmable-gate-array market. Innovations such as improved design tools and methodologies are enabling faster and more efficient development cycles. The introduction of high-level synthesis tools allows engineers to design complex systems with reduced time and effort. In the UK, the adoption of these advanced design techniques is expected to enhance productivity, leading to a projected market growth of 8% annually. Furthermore, the integration of artificial intelligence and machine learning capabilities into FPGAs is opening new avenues for applications, thereby expanding the market's potential.

Growing Focus on Data Processing Capabilities

The growing focus on data processing capabilities is a significant driver for the field programmable-gate-array market. With the rise of big data and analytics, organizations are seeking solutions that can efficiently process large volumes of information. FPGAs offer the advantage of parallel processing, making them ideal for data-intensive applications. In the UK, the demand for high-performance computing solutions is expected to increase by 12% over the next few years, further propelling the field programmable-gate-array market. This emphasis on enhanced data processing capabilities suggests a promising outlook for FPGA adoption across various sectors.

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the field programmable-gate-array market. UK-based companies are allocating substantial resources to innovate and enhance FPGA technologies. This focus on R&D is essential for developing next-generation products that meet the evolving needs of various industries. Reports indicate that R&D spending in the semiconductor sector has increased by 15% in the past year, reflecting a strong commitment to innovation. As companies strive to maintain a competitive edge, the field programmable-gate-array market is likely to see accelerated growth driven by these advancements.