Integration of Advanced Analytics

The integration of advanced analytics into communication systems is emerging as a pivotal driver in the enterprise communication-infrastructure market. Businesses are increasingly leveraging data analytics to gain insights into communication patterns, employee engagement, and operational efficiency. By utilizing analytics tools, organizations can identify bottlenecks in communication and optimize workflows. Reports indicate that companies employing analytics-driven communication strategies have seen productivity improvements of up to 25%. This trend suggests that the enterprise communication-infrastructure market will continue to evolve, as firms recognize the value of data in enhancing decision-making processes and fostering a more connected workforce.

Regulatory Compliance and Data Protection

Regulatory compliance and data protection are critical factors influencing the enterprise communication-infrastructure market. With stringent regulations such as GDPR in place, organizations must ensure that their communication systems adhere to legal standards. This compliance not only protects sensitive information but also builds trust with clients and stakeholders. As a result, businesses are investing in secure communication solutions that offer encryption and data management capabilities. The market for secure communication tools is projected to grow by 15% annually as companies prioritize compliance and risk management. This focus on regulatory adherence is likely to shape the future landscape of the enterprise communication-infrastructure market.

Focus on Employee Experience and Engagement

The focus on employee experience and engagement is becoming increasingly vital in the enterprise communication-infrastructure market. Organizations are recognizing that effective communication is essential for fostering a positive workplace culture and enhancing employee satisfaction. Research indicates that companies with high employee engagement levels experience 21% higher profitability. As a result, businesses are investing in communication tools that promote transparency, feedback, and collaboration among teams. This emphasis on employee-centric communication strategies is likely to drive growth in the enterprise communication-infrastructure market, as organizations strive to create environments that support their workforce's needs and aspirations.

Emergence of Unified Communication Solutions

The emergence of unified communication solutions is reshaping the enterprise communication-infrastructure market. These solutions integrate various communication channels, including voice, video, and messaging, into a single platform, enhancing user experience and operational efficiency. As organizations seek to streamline their communication processes, the adoption of unified communication systems is expected to rise significantly. Current estimates suggest that the market for unified communication solutions in the UK could reach £3 billion by 2026. This trend indicates a shift towards more cohesive communication strategies, allowing businesses to respond swiftly to market demands and improve overall collaboration.

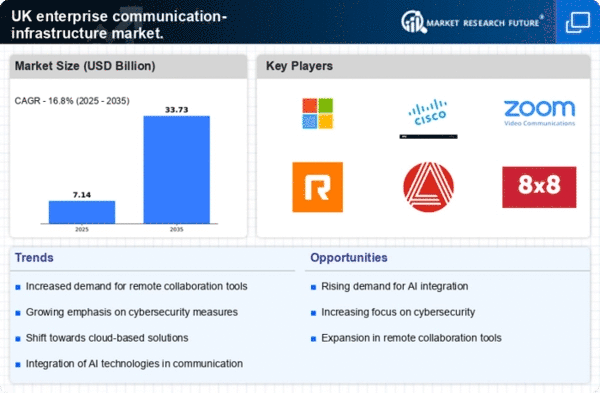

Increased Demand for Remote Collaboration Tools

The enterprise communication-infrastructure market is experiencing a notable surge in demand for remote collaboration tools. This trend is driven by the need for businesses to maintain productivity while accommodating flexible work arrangements. According to recent data, approximately 70% of UK companies have adopted some form of remote work, necessitating robust communication solutions. As organizations seek to enhance team collaboration, investments in platforms that facilitate video conferencing, instant messaging, and project management are likely to increase. This shift not only supports employee engagement but also fosters innovation and efficiency within teams. Consequently, the enterprise communication-infrastructure market is poised for growth as companies prioritize seamless communication channels to adapt to evolving work environments.