Industrial Automation Growth

The ongoing trend of industrial automation in the UK is significantly influencing the control valve market. As industries strive for enhanced efficiency and productivity, the adoption of automated control systems is becoming increasingly prevalent. This shift is particularly evident in sectors such as manufacturing, chemicals, and pharmaceuticals, where precision and reliability are paramount. The control valve market is projected to grow at a CAGR of 5% over the next five years, largely attributed to the rising implementation of automation technologies. Furthermore, the integration of the Internet of Things (IoT) and artificial intelligence (AI) into industrial processes is expected to drive demand for advanced control valves that can seamlessly interact with automated systems. Thus, the growth of industrial automation serves as a crucial driver for the control valve market, promoting technological advancements and operational efficiencies.

Focus on Process Optimization

The emphasis on process optimization across various industries in the UK is driving the demand for control valves. Companies are increasingly seeking ways to enhance operational efficiency, reduce waste, and improve product quality. Control valves play a critical role in achieving these objectives by regulating flow rates and maintaining desired pressure levels within systems. Industries such as food and beverage, oil and gas, and water treatment are particularly focused on optimizing their processes, leading to a projected increase in control valve adoption. Recent studies indicate that process optimization initiatives can lead to cost savings of up to 20%, further incentivizing companies to invest in advanced control valve technologies. Consequently, the focus on process optimization emerges as a vital driver for the control valve market, encouraging innovation and the development of more efficient solutions.

Rising Demand in Energy Sector

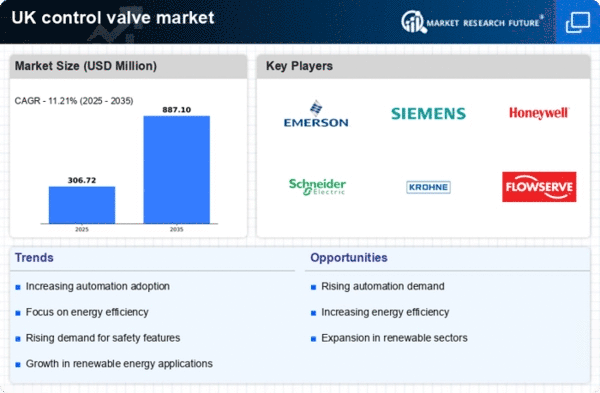

The energy sector in the UK is experiencing a notable surge in demand for control valves, driven by the need for efficient resource management and operational reliability. As the country transitions towards renewable energy sources, the control valve market is poised to benefit from increased investments in wind, solar, and hydroelectric power generation. This shift necessitates advanced control systems to manage the flow and pressure of various fluids, thereby enhancing the performance of energy facilities. According to recent data, the energy sector accounts for approximately 30% of the control valve market, indicating a robust growth trajectory. The integration of smart technologies further amplifies this demand, as operators seek to optimize processes and reduce operational costs. Consequently, the rising demand in the energy sector is a pivotal driver for the control valve market, fostering innovation and expansion within the industry.

Emergence of Smart Control Systems

The emergence of smart control systems is reshaping the landscape of the control valve market in the UK. As industries increasingly adopt digital technologies, the integration of smart control valves equipped with sensors and data analytics capabilities is becoming more prevalent. These advanced systems enable real-time monitoring and control, enhancing operational efficiency and reducing downtime. The market for smart control valves is expected to grow significantly, with projections indicating a CAGR of 7% over the next five years. This growth is driven by the need for improved process visibility and the ability to make data-driven decisions. Furthermore, the adoption of Industry 4.0 principles is likely to accelerate the demand for smart control systems, as companies seek to leverage automation and connectivity. Thus, the emergence of smart control systems stands as a key driver for the control valve market, fostering innovation and technological advancement.

Investment in Infrastructure Development

The UK government is actively investing in infrastructure development, which is anticipated to have a substantial impact on the control valve market. Major projects in transportation, water management, and energy infrastructure are underway, necessitating the use of control valves for effective fluid regulation and system management. For instance, the recent allocation of £100 billion towards infrastructure improvements is expected to create a surge in demand for control valves, as these components are essential for maintaining operational integrity in large-scale projects. Additionally, the focus on upgrading aging infrastructure presents further opportunities for the control valve market, as modern systems require advanced valve technologies to ensure safety and efficiency. Therefore, the investment in infrastructure development is a significant driver for the control valve market, fostering growth and innovation within the industry.