Integration of Digital Dentistry

The integration of digital dentistry into the UK CBCT dental market is transforming traditional practices. Digital workflows, including the use of CBCT imaging, are becoming standard in dental clinics, facilitating seamless communication between dental professionals and laboratories. This integration enhances the precision of restorations and orthodontic treatments, as digital impressions and CBCT images can be easily shared and analyzed. Furthermore, the UK government has been promoting digital health initiatives, which may further accelerate the adoption of CBCT technology. As practices transition to digital platforms, the demand for CBCT systems is likely to rise, reflecting a shift towards more efficient and patient-centered care. The potential for improved treatment outcomes and operational efficiencies positions the UK CBCT dental market for sustained growth.

Increased Awareness of Oral Health

There is a growing awareness of oral health among the UK population, which significantly impacts the UK CBCT dental market. Public health campaigns and educational initiatives have led to a heightened understanding of the importance of preventive care and early diagnosis. As patients become more informed about their oral health, they are more likely to seek advanced diagnostic options, such as CBCT imaging. This trend is supported by statistics indicating that dental visits have increased by 15% over the past three years. Consequently, dental practitioners are responding to this demand by incorporating CBCT technology into their practices, thereby enhancing their diagnostic capabilities. This shift not only improves patient care but also drives the growth of the UK CBCT dental market.

Technological Innovations in Imaging

Technological innovations play a crucial role in shaping the UK CBCT dental market. Continuous advancements in imaging technology, such as improved resolution and reduced radiation exposure, are making CBCT systems more appealing to dental professionals. The introduction of software solutions that enhance image analysis and interpretation further supports the adoption of CBCT technology. As a result, dental practices are increasingly recognizing the value of investing in state-of-the-art imaging systems. Market data suggests that the penetration of CBCT systems in dental practices has increased by approximately 20% in the last two years. This trend indicates a strong inclination towards adopting innovative technologies that enhance diagnostic accuracy and treatment planning, thereby propelling the growth of the UK CBCT dental market.

Rising Demand for Accurate Diagnostics

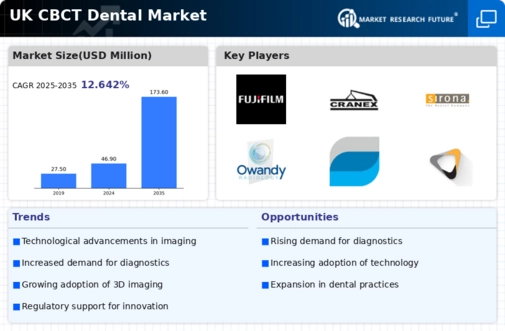

The UK CBCT dental market experiences a notable increase in demand for accurate diagnostics. As dental professionals seek to enhance treatment planning and patient outcomes, the adoption of Cone Beam Computed Tomography (CBCT) technology becomes essential. According to recent data, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is driven by the need for precise imaging in complex cases, such as implantology and orthodontics. The ability of CBCT to provide three-dimensional images allows for better visualization of anatomical structures, thereby improving diagnostic accuracy. Consequently, dental practices are increasingly investing in CBCT systems to meet patient expectations and improve clinical efficiency, indicating a robust trend within the UK CBCT dental market.

Regulatory Support for Advanced Imaging

Regulatory support for advanced imaging technologies is a significant driver in the UK CBCT dental market. The UK government and dental regulatory bodies have established guidelines that encourage the safe and effective use of CBCT systems in clinical practice. These regulations aim to ensure that dental professionals are adequately trained in the use of CBCT technology, thereby enhancing patient safety and treatment outcomes. Additionally, the availability of funding and grants for dental practices to acquire advanced imaging equipment further stimulates market growth. As regulatory frameworks evolve to support the integration of CBCT technology, dental practitioners are more likely to adopt these systems, contributing to the overall expansion of the UK CBCT dental market.