Growing Prevalence of Chronic Diseases

The catheters active-implantable-cdmo market is significantly influenced by the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and renal failure in the UK. As these conditions become more common, the demand for effective treatment options, including catheter-based interventions, is expected to rise. According to recent statistics, approximately 3.5 million people in the UK are living with diabetes, which necessitates the use of catheters for insulin delivery and other therapeutic applications. This growing patient population is likely to drive the expansion of the catheters active-implantable-cdmo market, as healthcare providers seek reliable solutions to manage chronic conditions effectively.

Technological Innovations in Catheter Design

The catheters active-implantable-cdmo market is witnessing a wave of technological innovations that enhance the performance and safety of catheters. Advancements such as biocompatible materials, smart catheters with integrated sensors, and improved delivery systems are transforming the landscape of catheter technology. These innovations not only improve patient outcomes but also reduce the risk of complications associated with catheter use. In the UK, the introduction of next-generation catheters is expected to capture a significant market share, as healthcare professionals increasingly adopt these advanced solutions. The continuous evolution of catheter design is likely to play a crucial role in shaping the future of the catheters active-implantable-cdmo market.

Rising Demand for Minimally Invasive Procedures

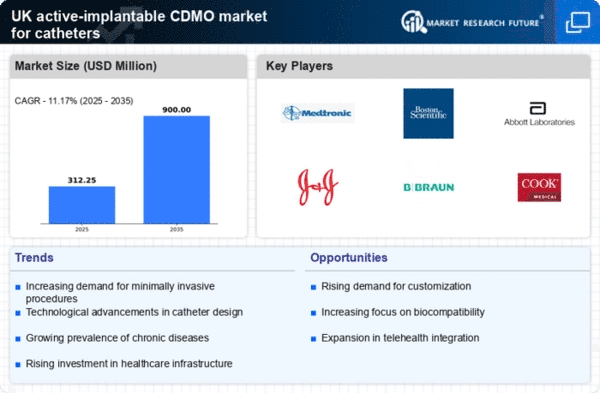

The catheters active-implantable-cdmo market experiences a notable surge in demand due to the increasing preference for minimally invasive procedures among healthcare providers and patients. This trend is driven by the advantages of reduced recovery times, lower risk of complications, and enhanced patient comfort. In the UK, the market for minimally invasive surgeries is projected to grow at a CAGR of approximately 8% over the next few years. As a result, manufacturers of catheters are focusing on developing advanced products that cater to this demand, thereby propelling the growth of the catheters active-implantable-cdmo market. The shift towards these procedures is likely to continue, influencing the design and functionality of catheters to meet evolving clinical needs.

Increased Investment in Healthcare Infrastructure

The catheters active-implantable-cdmo market benefits from the UK government's commitment to enhancing healthcare infrastructure. Recent investments aimed at modernizing hospitals and expanding healthcare facilities are expected to create a more conducive environment for the adoption of advanced medical devices, including catheters. The UK healthcare sector has seen an increase in funding, with an allocation of £20 billion for health services over the next five years. This financial support is likely to facilitate the procurement of innovative catheter technologies, thereby stimulating growth in the catheters active-implantable-cdmo market. Enhanced infrastructure not only improves patient access to care but also encourages the integration of cutting-edge medical devices into clinical practice.

Focus on Regulatory Compliance and Quality Standards

The catheters active-implantable-cdmo market is heavily influenced by the stringent regulatory environment in the UK. Regulatory bodies such as the Medicines and Healthcare products Regulatory Agency (MHRA) enforce rigorous quality standards for medical devices, including catheters. Compliance with these regulations is essential for manufacturers aiming to enter the market. The emphasis on quality assurance and safety is likely to drive innovation, as companies invest in research and development to meet regulatory requirements. This focus on compliance not only enhances product reliability but also fosters consumer trust in catheter technologies, thereby supporting the growth of the catheters active-implantable-cdmo market.