Regulatory Support

Regulatory support plays a pivotal role in shaping the UK Cardiac Output Monitoring Device Market. The Medicines and Healthcare products Regulatory Agency (MHRA) has established clear guidelines for the approval and monitoring of medical devices, ensuring that only safe and effective products reach the market. This regulatory framework not only fosters innovation but also instills confidence among healthcare providers and patients. The UK government has been actively promoting the adoption of advanced medical technologies, which is expected to further stimulate market growth. As a result, manufacturers are encouraged to invest in research and development, leading to the introduction of novel cardiac output monitoring solutions that meet stringent regulatory standards.

Technological Advancements

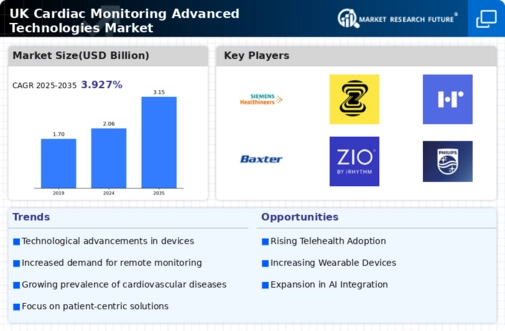

The UK Cardiac Output Monitoring Device Market is experiencing rapid technological advancements that enhance the accuracy and efficiency of cardiac output measurements. Innovations such as non-invasive monitoring techniques and portable devices are gaining traction among healthcare providers. For instance, the integration of advanced algorithms and artificial intelligence in monitoring devices allows for real-time data analysis, which is crucial for timely clinical decisions. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 8% in the coming years. This growth is driven by the increasing demand for precise monitoring solutions in critical care settings, where timely interventions can drastically improve patient outcomes.

Growing Geriatric Population

The growing geriatric population in the UK is another vital driver of the Cardiac Output Monitoring Device Market. As individuals age, the risk of developing cardiovascular diseases increases, necessitating regular monitoring of cardiac health. The Office for National Statistics (ONS) projects that the proportion of individuals aged 65 and over will continue to rise, leading to an increased demand for effective monitoring solutions. This demographic shift is prompting healthcare providers to adopt advanced cardiac output monitoring devices that cater to the specific needs of older patients. The market is likely to see substantial growth as manufacturers develop innovative solutions tailored for the geriatric population, ensuring that healthcare systems can adequately address the challenges posed by an aging society.

Focus on Patient-Centric Care

The shift towards patient-centric care is significantly influencing the UK Cardiac Output Monitoring Device Market. Healthcare providers are increasingly prioritizing personalized treatment plans that cater to individual patient needs. This trend is reflected in the growing adoption of cardiac output monitoring devices that offer tailored insights into patient health. The National Health Service (NHS) has been advocating for the integration of advanced monitoring technologies to enhance patient outcomes and satisfaction. As a result, the market is witnessing a surge in demand for devices that not only monitor cardiac output but also provide comprehensive data analytics. This focus on patient-centric solutions is likely to drive market expansion, as healthcare systems strive to improve the quality of care.

Rising Incidence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases (CVDs) in the UK is a critical driver for the Cardiac Output Monitoring Device Market. According to recent statistics, CVDs account for a significant proportion of deaths in the UK, prompting healthcare systems to seek effective monitoring solutions. The increasing prevalence of risk factors such as obesity, diabetes, and hypertension further exacerbates this issue. Consequently, there is a heightened demand for cardiac output monitoring devices that can aid in the early detection and management of these conditions. The market is expected to respond positively to this trend, with healthcare providers investing in advanced monitoring technologies to improve patient outcomes and reduce the burden of CVDs on the healthcare system.