Increased Awareness of Cardiac Health

There is a growing awareness of cardiac health among the population in the GCC region, which is significantly influencing the GCC Cardiac Output Monitoring Device Market. Public health campaigns and educational initiatives are raising awareness about the importance of monitoring cardiac health, particularly in light of rising incidences of cardiovascular diseases. This heightened awareness is driving demand for cardiac monitoring devices, as individuals seek proactive measures to manage their health. According to recent studies, the prevalence of heart disease in the GCC is projected to increase, prompting healthcare providers to invest in advanced monitoring solutions. Consequently, this trend is likely to sustain market growth as more patients and healthcare professionals recognize the value of cardiac output monitoring.

Growing Demand for Personalized Medicine

The GCC Cardiac Output Monitoring Device Market is witnessing a shift towards personalized medicine, which is reshaping the landscape of cardiac care. As healthcare providers increasingly recognize the importance of tailored treatment plans, the demand for advanced monitoring devices that can provide individualized data is on the rise. This trend is particularly relevant in the GCC, where healthcare systems are evolving to incorporate personalized approaches to patient management. The integration of cardiac output monitoring devices into personalized treatment regimens is expected to enhance the effectiveness of interventions, leading to improved patient outcomes. This growing focus on personalized medicine is likely to propel market growth, as healthcare providers seek innovative solutions to meet the unique needs of their patients.

Regulatory Support and Healthcare Policies

The GCC Cardiac Output Monitoring Device Market benefits from robust regulatory support and healthcare policies aimed at improving cardiac care. Governments in the region are implementing policies that encourage the adoption of advanced medical technologies, including cardiac monitoring devices. For instance, initiatives to enhance healthcare infrastructure and funding for medical research are likely to bolster market growth. The regulatory environment is becoming increasingly favorable, with streamlined approval processes for new devices, which could lead to a quicker introduction of innovative products. This supportive framework is essential for manufacturers looking to enter or expand within the GCC market, as it fosters a conducive environment for investment and development.

Rising Incidence of Cardiovascular Diseases

The GCC Cardiac Output Monitoring Device Market is significantly influenced by the rising incidence of cardiovascular diseases (CVDs) in the region. Factors such as sedentary lifestyles, unhealthy dietary habits, and increasing stress levels contribute to the growing prevalence of CVDs. As a result, healthcare systems are prioritizing the implementation of advanced monitoring solutions to manage and treat these conditions effectively. The World Health Organization has indicated that CVDs are among the leading causes of mortality in the GCC, which underscores the urgent need for effective monitoring devices. This trend is likely to drive investments in cardiac output monitoring technologies, as healthcare providers aim to enhance patient care and outcomes.

Technological Advancements in Monitoring Devices

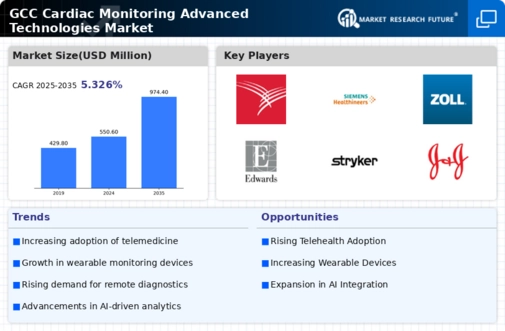

The GCC Cardiac Output Monitoring Device Market is experiencing a surge in technological advancements, which are enhancing the accuracy and efficiency of cardiac output monitoring. Innovations such as non-invasive monitoring techniques and advanced algorithms are being integrated into devices, allowing for real-time data analysis. This is particularly relevant in the GCC region, where healthcare facilities are increasingly adopting cutting-edge technologies to improve patient outcomes. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% from 2026 to 2031, driven by these advancements. Furthermore, the introduction of wearable devices is expected to expand the market reach, making cardiac monitoring more accessible to patients outside traditional clinical settings.