Regulatory Framework Enhancements

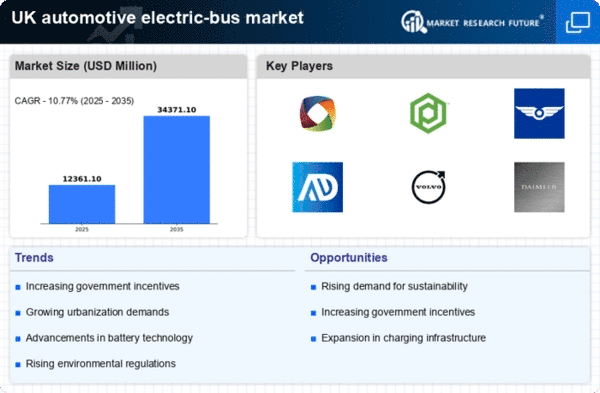

The automotive electric-bus market is experiencing a robust transformation due to the evolving regulatory framework in the UK. The government has introduced stringent emissions regulations aimed at reducing air pollution, which has led to increased investments in electric bus technologies. For instance, the UK aims to have all new buses zero-emission by 2035, which is likely to drive demand for electric buses significantly. This regulatory push not only encourages manufacturers to innovate but also incentivizes public transport operators to transition to electric fleets. The automotive electric-bus market is thus positioned to benefit from these regulations, as compliance becomes a necessity for operators, potentially leading to a market growth rate of over 20% annually in the coming years.

Infrastructure Development Initiatives

Infrastructure development plays a crucial role in the automotive electric-bus market, particularly in the context of charging stations and maintenance facilities. The UK government has committed substantial funding to enhance the charging infrastructure, with plans to install thousands of charging points across urban areas. This initiative is expected to alleviate range anxiety among operators and encourage the adoption of electric buses. Furthermore, the integration of smart grid technologies could optimize energy usage, making electric buses more viable. As a result, the automotive electric-bus market is likely to see a surge in adoption rates, with projections indicating that the number of electric buses could triple by 2030, driven by improved infrastructure.

Public Transport Modernization Efforts

Public transport modernization efforts are significantly influencing the automotive electric-bus market. Many UK cities are actively seeking to modernize their public transport systems to enhance service quality and reduce environmental impact. This modernization often includes the integration of electric buses into existing fleets, driven by the need for cleaner and more efficient transport solutions. Local authorities are increasingly recognizing the benefits of electric buses, not only in terms of emissions reduction but also in improving public health and urban air quality. Consequently, the automotive electric-bus market is poised for growth, with estimates suggesting that electric buses could account for over 30% of the total bus fleet in major cities by 2035.

Economic Incentives for Fleet Transition

Economic incentives are a pivotal driver for the automotive electric-bus market in the UK. The government has introduced various financial support mechanisms, including grants and subsidies for public transport operators transitioning to electric fleets. These incentives can cover a significant portion of the initial investment costs, making electric buses more financially attractive. For example, the UK government has allocated £500 million to support the transition to zero-emission buses, which could lead to a substantial increase in fleet electrification. This financial backing not only reduces the economic burden on operators but also stimulates market growth, as more entities are likely to invest in electric buses, potentially doubling the market size by 2030.

Technological Innovations in Electric Bus Design

Technological innovations are reshaping the automotive electric-bus market, particularly in design and efficiency. Advances in lightweight materials and aerodynamics are enhancing the performance of electric buses, making them more energy-efficient. Additionally, improvements in battery technology, such as solid-state batteries, are expected to increase range and reduce charging times. These innovations are crucial for meeting the demands of urban transport systems, where efficiency and reliability are paramount. As manufacturers continue to invest in research and development, the automotive electric-bus market is likely to witness a wave of new models that offer superior performance, potentially increasing market penetration by 15% annually.

Leave a Comment