Regulatory Framework Enhancements

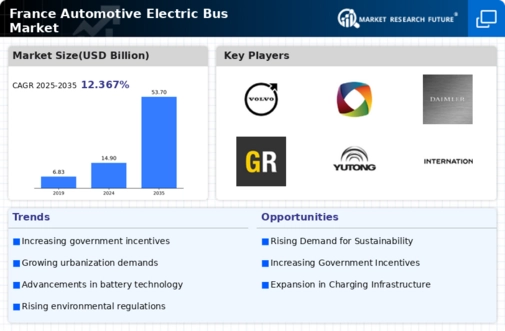

The automotive electric-bus market in France is experiencing a robust transformation due to the implementation of stringent regulatory frameworks aimed at reducing carbon emissions. The French government has established ambitious targets to achieve carbon neutrality by 2050, which necessitates a significant shift towards electric public transport solutions. This regulatory environment encourages local authorities to invest in electric bus fleets, thereby stimulating demand within the automotive electric-bus market. Furthermore, the European Union's directives on emissions standards compel manufacturers to innovate and comply with these regulations, fostering a competitive landscape. As a result, the automotive electric-bus market is likely to witness accelerated growth, with projections indicating a potential increase in electric bus adoption by over 30% by 2030.

Economic Viability and Cost Savings

The automotive electric-bus market in France is significantly influenced by the economic viability of electric buses compared to traditional diesel counterparts. The total cost of ownership for electric buses is becoming increasingly favorable, with operational costs estimated to be 30% lower due to reduced fuel and maintenance expenses. Additionally, the French government offers financial incentives that further enhance the attractiveness of electric buses for public transport operators. As municipalities seek to optimize their budgets while meeting environmental goals, the shift towards electric buses appears to be a financially sound decision. This trend is likely to drive the automotive electric-bus market, with an anticipated growth rate of 25% in the next five years.

Infrastructure Development Initiatives

The expansion of charging infrastructure is a critical driver for the automotive electric-bus market in France. The government has recognized the necessity of establishing a comprehensive network of charging stations to support the growing fleet of electric buses. Investments in this infrastructure are expected to reach approximately €1 billion by 2027, facilitating the seamless operation of electric buses across urban areas. This initiative not only alleviates range anxiety among operators but also enhances the overall viability of electric public transport. Consequently, the automotive electric-bus market is poised for growth as municipalities increasingly prioritize electric bus deployment, with a projected increase in infrastructure availability by 50% over the next five years.

Public Transport Modernization Efforts

The automotive electric-bus market in France is being propelled by ongoing modernization efforts within public transport systems. Cities are increasingly recognizing the need to upgrade their aging bus fleets to meet contemporary environmental standards and passenger expectations. This modernization is often accompanied by a commitment to sustainability, prompting the transition to electric buses. Municipalities are investing heavily in new electric bus purchases, with projections indicating that over 40% of new bus acquisitions will be electric by 2030. This shift not only enhances the quality of public transport but also aligns with broader environmental objectives, thereby driving the automotive electric-bus market forward.

Technological Innovations in Electric Buses

Technological advancements are playing a pivotal role in shaping the automotive electric-bus market in France. Innovations in battery technology, such as increased energy density and faster charging capabilities, are enhancing the performance and efficiency of electric buses. These developments are crucial for addressing the operational challenges faced by public transport systems. Furthermore, the integration of smart technologies, including telematics and real-time monitoring systems, is improving fleet management and operational efficiency. As these technologies continue to evolve, they are expected to attract more operators to the automotive electric-bus market, potentially leading to a market growth of 20% by 2028.