Increasing Vehicle Ownership

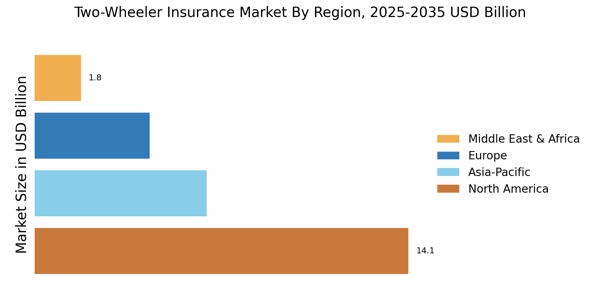

The rise in vehicle ownership, particularly in developing regions, appears to be a primary driver for the Two-Wheeler Insurance Market. As urbanization accelerates, more individuals are purchasing two-wheelers for convenience and cost-effectiveness. According to recent statistics, the number of registered two-wheelers has surged, with millions of new registrations annually. This trend not only reflects a growing preference for personal mobility but also indicates a heightened need for insurance coverage. As more consumers invest in two-wheelers, the demand for comprehensive insurance policies is likely to increase, thereby propelling the Two-Wheeler Insurance Market forward. Insurers are responding by offering tailored products that cater to the diverse needs of this expanding customer base, which may further stimulate market growth.

Shift Towards Comprehensive Coverage

There is a noticeable shift among consumers towards seeking comprehensive insurance coverage, which may significantly impact the Two-Wheeler Insurance Market. Riders are increasingly aware of the limitations of basic third-party insurance and are opting for policies that offer broader protection, including coverage for theft, damage, and personal injury. This trend is supported by market data indicating that comprehensive policies are gaining popularity, with a substantial percentage of new policyholders choosing these options. Insurers are responding by developing more inclusive packages that cater to the evolving needs of consumers. As this shift continues, the Two-Wheeler Insurance Market is expected to expand, driven by the demand for more robust insurance solutions.

Growing Awareness of Insurance Benefits

Consumer awareness regarding the benefits of insurance is on the rise, which appears to be a crucial driver for the Two-Wheeler Insurance Market. Educational campaigns and increased access to information have led to a better understanding of the importance of insurance in mitigating financial risks associated with accidents and theft. As individuals become more informed, they are more likely to seek out insurance coverage for their two-wheelers. This trend is particularly evident among younger riders, who are increasingly recognizing the value of protecting their investments. Consequently, the Two-Wheeler Insurance Market is likely to see a boost in policy subscriptions as awareness continues to grow, prompting insurers to enhance their marketing strategies to reach this demographic.

Technological Advancements in Insurance

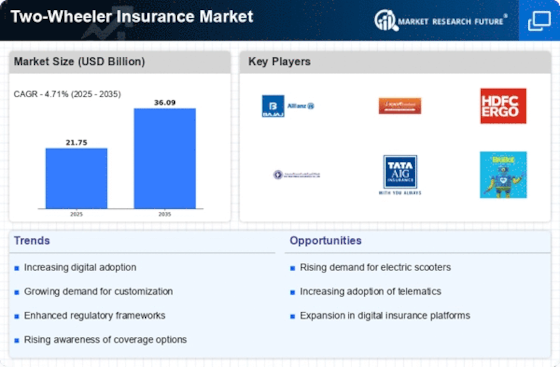

Technological innovations are reshaping the landscape of the Two-Wheeler Insurance Market. The integration of digital platforms and mobile applications has made it easier for consumers to purchase and manage their insurance policies. Insurers are leveraging data analytics and artificial intelligence to assess risk more accurately, which could lead to more personalized insurance offerings. Moreover, telematics technology allows for real-time monitoring of riding behavior, potentially resulting in lower premiums for safe riders. As these technologies become more prevalent, they are likely to attract a tech-savvy demographic, further expanding the market. The Two-Wheeler Insurance Market is thus positioned to benefit from these advancements, as they enhance customer experience and operational efficiency.

Regulatory Compliance and Safety Standards

Regulatory frameworks governing vehicle insurance are evolving, which seems to be a significant factor influencing the Two-Wheeler Insurance Market. Governments are increasingly mandating insurance coverage for two-wheelers to enhance road safety and protect consumers. For instance, many regions require third-party liability insurance as a minimum, which has led to a surge in policy uptake. Additionally, safety standards are becoming more stringent, compelling manufacturers and consumers alike to prioritize insurance. This regulatory push not only ensures that riders are protected but also fosters a competitive environment among insurers, who are now innovating to meet compliance requirements. Consequently, the Two-Wheeler Insurance Market is likely to experience growth as more riders seek to adhere to these regulations.