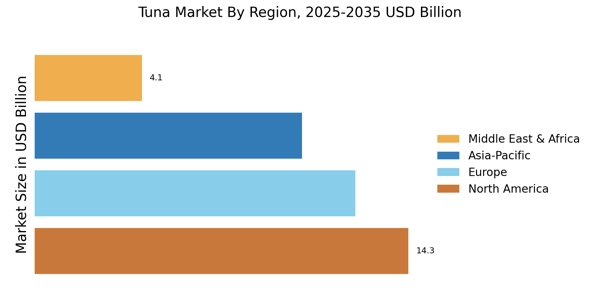

By Region, the study segments the market into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Europe Tuna Market accounts for the largest market share 36.1% in 2023 and is expected to exhibit a 3.2% CAGR.

Figure 5: Tuna Market Share By Region 2023 (%)

North America, canned tuna is still a household and restaurant staple. This ongoing popularity stems mostly from its convenience, long shelf life, and versatility in a variety of recipes such as sandwiches, salads, and casseroles. Starkist, Bumble Bee, and Chicken of the Sea dominate the canned tuna industry, offering a variety of goods from plain to flavored to meet a wide range of consumer preferences.

Aside from canned tuna, fresh and frozen tuna have a significant market share in North America, particularly in coastal regions with considerable seafood consumption. Sushi and sashimi cultures increase demand for high-quality fresh tuna, as restaurants and sushi bars source tuna for their premium meals. Yellowfin tuna, in particular, is highly regarded for its mild flavor and adaptability in both raw and cooked forms.

Asia-Pacific market value is USD 9,807.19 in 2023 and USD 16,257.46 in 2032 growing at a CAGR of 6.52% during the forecast period. Asia-Pacific includes China, Japan, India, Australia & New Zealand, South Korea, and the Rest of Asia-Pacific are all included in the analysis of the market. India continues to hold a significant share in the Tuna Market, owing to the wide consumption of Tuna Market among the various consumer groups. As a part of this, according to MRFR analysis, Tuna Market are thought to account for around 85% of the roughly Rs 2500 crore salty snack food market in India.

The modest potato chip, which appeals to both young and old, has proved more effective than any exotic product in capturing the Indian market. Branded chips taste amazing and appear to be less greasy. Furthermore, the increasing government support to strengthen the potato chip sector coupled with the growing expansion policies adopted by key players across the region is expected to open huge opportunities for its market growth in the upcoming years.

Europe has a substantial impact on the worldwide tuna market because of a combination of consumption habits, trade dynamics, and regulatory frameworks that shape its industry environment. Tuna Market plays an important role in European cuisine, with both canned and fresh versions being extensively consumed across the continent. Canned tuna is quite popular in Europe due to its ease and long shelf life. It is a common ingredient in sandwiches, salads, and pasta meals.

Brands such as John West, Rio Mare, and Princes dominate the canned tuna industry in Europe, offering a variety of alternatives such as tuna in oil, brine, or with added flavors to meet a wide range of consumer tastes.

Asia Pacific is both a big consumer and producer of tuna. Thailand, Indonesia, the Philippines, and Vietnam are among the world's leading tuna producers, supplying both home and international markets. These countries frequently engage in tuna fishing, processing, and canning businesses, which benefit local economies and contribute to worldwide supply networks. The region's regulatory system differs by country, although it generally prioritizes sustainable fishing techniques and resource management. Organizations such as the Western and Central Pacific Fisheries Commission (WCPFC) are crucial in controlling tuna populations and maintaining sustainable harvesting techniques throughout the Pacific Ocean, a key tuna fishing zone.