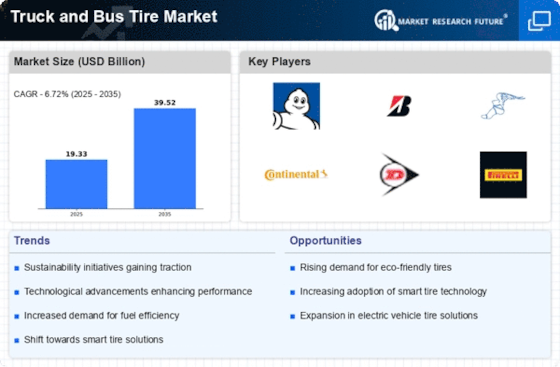

Growth of Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is poised to impact the Truck and Bus Tire Market significantly. As more manufacturers introduce electric models, there is a growing need for specialized tires that can accommodate the unique weight distribution and performance characteristics of these vehicles. Electric and hybrid trucks often require tires that provide lower rolling resistance to enhance energy efficiency. This shift in vehicle technology is likely to create new opportunities for tire manufacturers to develop innovative products tailored to the specific requirements of electric and hybrid trucks, thereby driving growth in the Truck and Bus Tire Market.

Rising Fuel Prices and Cost Efficiency

Rising fuel prices are influencing purchasing decisions within the Truck and Bus Tire Market. Fleet operators are increasingly seeking tires that offer better fuel efficiency to mitigate operational costs. Tires designed with advanced tread patterns and materials can significantly reduce rolling resistance, leading to lower fuel consumption. This trend is particularly relevant as fuel prices fluctuate, prompting operators to invest in high-performance tires that promise long-term savings. Consequently, the demand for fuel-efficient tires is expected to grow, further propelling the Truck and Bus Tire Market as operators prioritize cost-effective solutions.

Regulatory Compliance and Safety Standards

Regulatory compliance plays a crucial role in shaping the Truck and Bus Tire Market. Governments worldwide are implementing stringent safety standards aimed at reducing road accidents and enhancing vehicle performance. These regulations often mandate the use of specific tire types that meet safety and environmental criteria. For instance, the introduction of regulations regarding tire pressure monitoring systems has led to increased demand for tires that are compatible with these technologies. Consequently, manufacturers are compelled to innovate and produce tires that not only comply with regulations but also offer superior performance, thereby driving growth in the Truck and Bus Tire Market.

Increasing Demand for Freight Transportation

The Truck and Bus Tire Market is experiencing a notable surge in demand for freight transportation. This trend is largely driven by the expansion of e-commerce and the need for efficient logistics solutions. As businesses increasingly rely on road transport for timely deliveries, the demand for heavy-duty tires that can withstand rigorous conditions is on the rise. In fact, the freight transportation sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth necessitates the development of advanced tire technologies that enhance durability and performance, thereby propelling the Truck and Bus Tire Market forward.

Technological Innovations in Tire Manufacturing

Technological innovations are transforming the Truck and Bus Tire Market. Advances in materials science and manufacturing processes are enabling the production of tires that are lighter, more durable, and fuel-efficient. For example, the integration of smart technologies, such as sensors that monitor tire health in real-time, is becoming increasingly prevalent. These innovations not only enhance the performance of tires but also contribute to cost savings for fleet operators through improved fuel efficiency and reduced maintenance costs. As a result, the Truck and Bus Tire Market is likely to witness a shift towards high-tech tire solutions that cater to the evolving needs of the transportation sector.

.png)