Focus on Safety and Risk Management

Safety concerns in transportation are prompting a heightened focus on risk management strategies, which is beneficial for the transportation predictive-analytics market. In South America, the increasing number of road accidents has led to a demand for solutions that can predict and mitigate risks. The implementation of predictive analytics can help identify high-risk areas and optimize safety measures. For instance, data from traffic reports indicates that road accidents in urban areas have increased by 15% over the past five years. By leveraging predictive analytics, transportation authorities can enhance safety protocols and reduce accident rates, thereby fostering a safer transportation environment.

Growing Urbanization and Mobility Needs

The rapid urbanization in South America is driving the demand for efficient transportation solutions. As cities expand, the need for predictive analytics in transportation becomes increasingly critical. Urban areas are experiencing population growth, leading to congestion and inefficiencies in transport systems. The transportation predictive-analytics market is poised to benefit from this trend, as stakeholders seek to optimize routes and improve service delivery. According to recent estimates, urban populations in South America are expected to reach 80% by 2030, necessitating advanced analytics to manage the complexities of urban mobility. This growth presents opportunities for companies specializing in predictive analytics to develop tailored solutions that address the unique challenges faced by urban transport systems.

Rising Demand for Real-Time Data Insights

The transportation predictive-analytics market is experiencing a surge in demand for real-time data insights, driven by the need for timely decision-making in transportation operations. Companies are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and customer satisfaction. In South America, logistics and transportation firms are adopting predictive analytics to monitor fleet performance and optimize delivery schedules. This trend is underscored by a report indicating that 65% of logistics companies in the region are investing in data analytics tools to improve service levels. The ability to analyze data in real-time allows organizations to respond swiftly to changing conditions, thereby enhancing their competitive edge.

Emergence of E-commerce and Last-Mile Delivery

The growth of e-commerce in South America is reshaping the transportation landscape, creating new opportunities for the transportation predictive-analytics market. As online shopping continues to rise, the demand for efficient last-mile delivery solutions is becoming paramount. Companies are increasingly turning to predictive analytics to optimize delivery routes and reduce operational costs. For example, a study shows that last-mile delivery costs can account for up to 30% of total logistics expenses. By utilizing predictive analytics, businesses can enhance their delivery efficiency, ultimately improving customer satisfaction. This trend indicates a robust market potential for analytics solutions tailored to the evolving needs of e-commerce logistics.

Government Investments in Smart Infrastructure

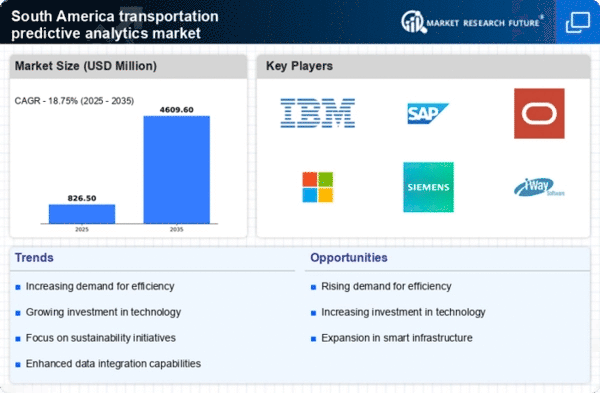

Governments across South America are increasingly investing in smart infrastructure projects, which significantly impacts the transportation predictive-analytics market. These investments aim to enhance the efficiency and safety of transportation networks. For instance, Brazil has allocated approximately $10 billion for smart city initiatives, which include the integration of predictive analytics to improve traffic management and reduce accidents. Such government initiatives not only foster innovation but also create a conducive environment for the adoption of advanced analytics technologies. As public agencies prioritize data-driven decision-making, the demand for predictive analytics solutions is likely to surge, providing a substantial boost to the market.