Transformer Size

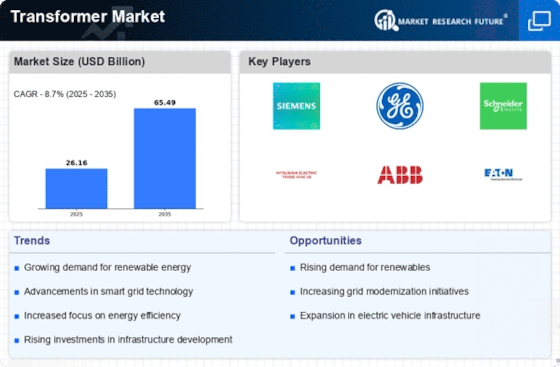

Transformer Market Growth Projections and Opportunities

The global demand for advanced monitoring systems is increasing rapidly, driven by factors such as the expansion of power infrastructure and the implementation of smart grid projects.

The transformer monitoring system market is anticipated to experience a Compound Annual Growth Rate (CAGR) of 11.81% during the forecast period from 2020 to 2026. In 2019, the Asia-Pacific region dominated the global market, accounting for a 31.0% share, followed by North America with a 25.5% share and Europe with a 21.2% share.

The market has been categorized based on type, service, application, and region. The types of transformer monitoring systems include hardware and software. While the hardware segment held the majority share (59.65%) in 2019, the software segment is expected to grow at a faster rate in the coming years.

In terms of service, the transformer monitoring system market includes oil and gas monitoring, bushing monitoring, voltage regulation, and others. The oil and gas monitoring segment is projected to exhibit accelerated growth during the forecast period, holding a 36.19% share in 2019.

The application segment comprises power transformers, distribution transformers, and others. The power transformers segment is expected to grow at a faster rate, accounting for 50.85% of the global transformer monitoring system market in 2019.

Geographically, the global market is divided into Asia-Pacific, North America, Europe, Middle East & Africa, and South America. In 2019, Asia-Pacific held a substantial 31.0% share of the global transformer monitoring system market.

The increasing demand for transformer monitoring systems is fueled by the need for more efficient and reliable monitoring solutions in power infrastructure and smart grid projects. As technology continues to advance, the software segment is anticipated to play a crucial role in the market's growth, offering enhanced capabilities for monitoring and analysis.

The oil and gas monitoring service is gaining prominence due to its faster growth rate, reflecting the industry's recognition of the importance of monitoring these specific aspects in transformer systems. Similarly, the power transformers application segment is expected to witness accelerated growth, emphasizing the significance of monitoring in power transmission and distribution.

In summary, the global transformer monitoring system market is experiencing substantial growth, driven by the increasing demand for advanced monitoring solutions in the power sector. The market's segmentation based on type, service, and application provides insights into the specific areas where these monitoring systems are most crucial, contributing to the overall efficiency and reliability of power infrastructure worldwide.

Leave a Comment